Greenback Falls As Deepening Recession May Spur Action

Greenback Falls As Deepening Recession May Spur Action

Hans Nilsson 2009-02-06

www.cmsfx.com

* The dollar and yen were lower on Friday as risk appetite increased and demand for safe haven flows declined. US stocks rallied for a second day on optimism the government’s financial-recovery stimulus package will pass soon following today’s reports on dismal job losses. Nonfarm payrolls fell the most since December 1974 and the unemployment rate reached the highest level since September 1992. Sterling was supported by the Bank of England’s announcement that the BOE may start buying commercial paper next week. The euro rose on improved sentiment despite German industrial production dropping the most on record. The Canadian dollar fell on more-than-expected Canadian job losses but later reversed losses as risk aversion decreased. The Australian dollar rallied after breaking resistance and a relatively optimistic economic forecast by the Reserve Bank of Australia.

* The EUR/JPY, strongly correlated with the US stock market and risk appetite, rose as US stocks rallied. Financial shares surged on speculation US Treasury Secretary Timothy Geithner will present a plan that will guarantee banks’ toxic assets. The EUR/JPY fell as low as 112 when US stocks measured by the S&P 500 successfully tested the 800-area support on January 21. After further successful tests of the support, the EUR/JPY is now ready for a test of the resistance from its long-term downtrend. If the administration’s stimulus plan gets a good reception next week, the EUR/JPY will break the downtrend indicating further gains in both the pair and stocks.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US nonfarm payrolls fell a more-than-expected 598,000 in January, the most since December 1974, while revisions to November and December subtracted extra 66,000 jobs, data from the Labor Department showed. Private payrolls dropped 604,000, with declines in almost all key sectors. The weakest job categories were manufacturing (down 207,000), construction (down 111,000) and employment services – such as temps – (down 89,000). The strongest sector was health and education (up 54,000). The unemployment rate rose more than expected to 7.6% in January, the highest level since September 1992, from 7.2% in December. Average hourly earnings increased 0.3% m/m in January and increased 3.9% y/y, both higher than expected.

www.cmsfx.com

* Canada’s employers cut a net 129,000 workers in January, three times the loss forecast and the biggest drop since 1976, after a 20,400 decline in December, Statistics Canada reported. The unemployment rate rose to a 4-year high of 7.2% in January from 6.6% in December. The steep job losses indicate Canada’s economic contraction is far from over, pointing to further Bank of Canada interest-rate cuts.

www.cmsfx.com

Europe

* Germany’s industrial production fell a seasonally adjusted 4.6% m/m in December, the fourth consecutive monthly decline and the largest since records began in January 1991, following November’s downwardly revised 3.7% m/m decline, the Economy Ministry said. Industrial production in December dropped 12.0% y/y.

www.cmsfx.com

* UK PPI output unexpectedly increased 0.1% m/m in January, following a downwardly revised 0.1% m/m decline in December, according to the Office for National Statistics (ONS). The PPI output rose 3.5% y/y in January, the slowest pace since September 2007.

* UK industrial production declined a more-than-expected 1.7% m/m in December after a downwardly revised 2.5% m/m fall in November, according to ONS data. Industrial production fell a more-than-expected 9.4% y/y following November’s downwardly revised 7.8% y/y fall. Meanwhile, manufacturing production declined a more-than-expected 2.2% m/m in December after a downwardly revised 3.0% m/m fall in November. Manufacturing production dropped a more-than-expected 10.2% y/y following November’s downwardly revised 8.3% y/y drop. Overall, the December figures show deteriorating UK economic conditions amid a deepening recession, pointing to the possibility of a downward revision of Q4 2008 UK GDP data.

www.cmsfx.com

* Individual insolvencies in England and Wales rose 8.2% in Q4 2008 to 29,444, the highest since 2006, the Insolvency Service said.

Asia-Pacific

* Japan’s leading index fell further to 79.8 in December, preliminary data from the Economic and Social Research Institute showed, from 81.3 in November. The coincident index continued its decline to 92.3 following November’s 94.9. The figures indicate continued deterioration in the Japanese economy.

* The Reserve Bank of Australia cut its forecasts for economic growth and inflation. Australia’s GDP will rise 0.25% in the 12 months through June, compared with the RBA’s November forecast of 1.5% growth for the same period. Consumer-price inflation, which rose 3.7% in Q4 2008, will increase 1.75% in the 12 months through June, compared with the bank’s November forecast of 3.25%.

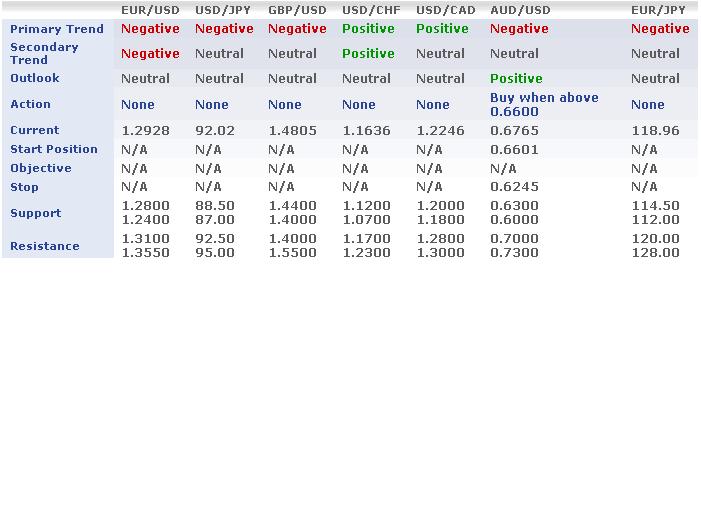

FX Strategy Update

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The commentaries, charts, and information provided on this website are not intended as trading advice. Please contact a registered trading advisor if you have any questions.

This report is intended solely for distribution to customers of Capital Market Services, L.L.C. Any information in this report is based on data obtained from sources considered to be reliable, but no representations or guarantees are made by Capital Market Services, L.L.C. with regard to the accuracy of the data. The opinions and estimates contained herein constitute our best judgment at this date and time, and are subject to change without notice. Capital Market Services, L.L.C. accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this report. No part of this report may be reproduced or distributed in any manner without the permission of Globicus International, Inc.

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

Источник: ©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

06.02.2009

Динамика валютных курсов

Динамика валютных курсов