Dollar and Yen Drop as Dow Falls to 6-Year Low

* The dollar gained against the yen but fell versus other key currencies on Thursday. US employment conditions continued to deteriorate as the number of unemployed reached nearly 5 million. US produce-price inflation rose more than expected, easing deflation fears. The Conference Board US LEI unexpectedly rose, indicating the US steep economic decline may bottom out this summer. The rising PPI and improving LEI may have helped reduce risk aversion. The dollar and yen weakened on decreased safe haven demand despite the Dow industrials’ fall to a new bear-market closing low as bank stocks continued to grind downward. The yen fell against the greenback and in cross trades. The Bank of Japan said it will increase effort to ease the credit crunch by purchase of Japanese corporate bonds. Sterling rose modestly despite lower tax receipts in January driving the budget deficit to the highest level since records began in 1993 and the Office for National Statistics saying UK public finances were in worse shape than expected. The Australian and Canadian dollars advanced as commodity prices rose. Crude oil rallied 14% on an unexpected drop in US inventories. The Swiss franc fell on questions over the nation’s bank secrecy after UBS agreed to hand over data to the US authorities on clients involved in tax fraud.

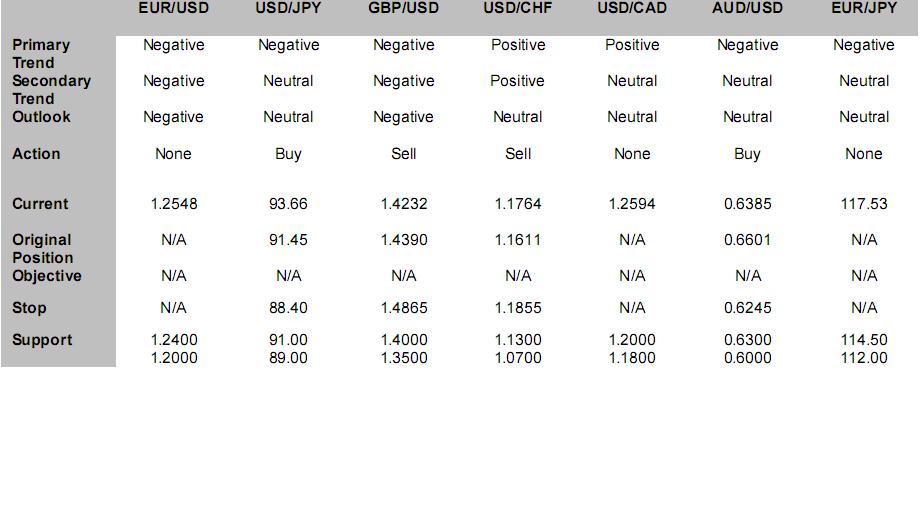

* The EUR/USD found support at the 1.25 handle and rose following reports that the German government plans to take action to help relieve financial turmoil in Europe. The EUR/USD trend is still down. We expect further challenges to the support in the 1.24-1.25 area and view today’s action as a relief rally. If the short-term downtrend is broken, the pair is likely to rise. This could happen if the equity market finds support here, which would likely lead to a rally in stocks and most key currencies except the yen and dollar.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* The Conference Board US leading economic indicators index unexpectedly increased 0.4% to 99.5 in January, the most since December 2006, led by a rise in money supply and the yield curve, following December’s downwardly revised 0.2% increase, the Conference Board reported. Money supply added 0.54 percentage point to the January LEI and the yield curve added 0.23 percentage point. The coincident index, a gauge of current economic activity, fell 0.5% for a third consecutive month in January to 103.3, driven down by industrial production and employees on nonagricultural payrolls. The lagging index declined 0.1% after December’s 0.2% fall. The government’s monetary policy stimulus is likely to ease the intensity of the economic contraction in Q2 2009; however, it is too early to call for a US economic recovery.

www.cmsfx.com

* US producer prices increased a more-than-expected 0.8% m/m in January, reversing some of the December’s 1.9% m/m drop, data from the Labor Department showed. The PPI declined 1.0% y/y. Most of the January month-on-month PPI increase was attributable to energy, which rose 3.7% m/m. Food prices declined 0.4% m/m. The core PPI, which excludes food and energy, advanced a more-than-expected 0.4% m/m in January and rose 4.2% y/y. Consumer goods prices increased 1.0% m/m in January but fell 2.4% y/y. Capital equipment prices increased 0.5% m/m in January and rose 4.0% y/y. Intermediate goods prices declined 0.7% m/m in January and fell 3.7% y/y. Crude prices fell 2.9% m/m in January and dropped 28.9% y/y. In short, the January month-on-month PPI gain, while easing deflation concerns, is less likely to continue as other US economic data showed further deterioration in the job market and manufacturing.

www.cmsfx.com

* US initial jobless claims in the week ending February 14 were unchanged at 627,000, higher than expected and just 4,000 shy of the 26-year high reached at the end of January, data from the Labor Department showed. Continuing jobless claims in the week ending February 7 jumped 170,000 to 4,987,000, the highest level since records began in 1967, from the prior week’s revised 4,817,000. The insured unemployment rate rose to 3.7% for the week ending February 7 from the preceding week’s 3.6%. Overall, the figures suggest another dismal employment report for February.

* The Philadelphia Fed general business activity index fell more than expected to -41.3 in February from -24.3 in January, indicating manufacturing in the Philadelphia region contracted in February at the fastest pace in more than 18 years, the Federal Reserve Bank of Philadelphia reported. The employment index fell to -45.8 in February, the lowest level since records began in 1968, from -39.0 in January. The new orders index plunged to -30.3 from -22.3. The shipments index dropped to -32.4, also the lowest on record. The prices paid index increased to -13.7 from -27.0, while the prices received index declined to -27.8 from -26.2.

www.cmsfx.com

* Canada’s leading economic indicators index declined 0.8% in January, its fifth consecutive drop and the most since 1982, led by declines in housing and stocks, Statistics Canada reported. The index of housing starts and sales fell 7.0%, the most since June 1990. Stock prices dropped 9.5%.

Europe

* Business expectations of German firms dropped to a record low -39 in January from -9 in October, the German Chamber of Industry and Commerce (DIHK) reported, adding that the economy is expected to contract up to 3.0% in 2009.

* Provisional data of the UK public finances showed that in January the public sector had a budget surplus of £8.4 billion and net borrowing of -£3.3 billion, and at the end of January, net debt was £703.4 billion, equivalent to 47.8% of GDP, the Office for National Statistics reported.

* Switzerland’s trade surplus jumped to CHF 2.03 billion in January from zero in December, the Federal Customs Office said. Exports rose 6.7% m/m to CHF14.6 billion after dropping 13.1% m/m, while imports increased 0.8% m/m to CHF 12.57 billion.

* The Credit Suisse ZEW economic expectations indicator increased to -57.7 in February from -66.7 in January, according to the latest economic survey by Credit Suisse in cooperation with the Centre for European Economic Research (ZEW), indicating a deteriorating economic condition with slightly better expectations.

Asia-Pacific

* The Bank of Japan voted unanimously to keep its key interest rate unchanged at 0.10%, as forecast. In the February 19 BOJ monetary policy statement, the BOJ said “economic conditions have deteriorated significantly and are likely to continue deteriorating for the time being,” adding that “CPI inflation (excluding fresh food) has recently moderated reflecting the declines in the prices of petroleum products and the stabilization of food prices, and, with increasing slackness evident in supply and demand conditions, will likely become negative by the spring.” The BOJ projects “the economy will start recovering from the latter half of fiscal 2009, with price declines abating as global financial markets regain stability and overseas economies move out of their deceleration phase.” However, the BOJ warned that “although this scenario offers the prospect of the economy returning to a sustainable growth path with price stability in the latter half of the projection period, uncertainty is high.”

* BOJ Governor Masaaki Shirakawa said economic conditions in Japan are expected to remain “severe” in Q1 and Q2.

* Tokyo department store sales rose 9.6% y/y in January, while nationwide department store sales fell 9.1% y/y, the Japan Department Store Association reported.

FX Strategy Update

Hans Nilsson and Winnie Tapasanun

New York, February 19, 2009, 17:16 EST

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

Источник: Hans Nilsson

19.02.2009

Динамика валютных курсов

Динамика валютных курсов