Greenback Gains on Renewed Risk Aversion

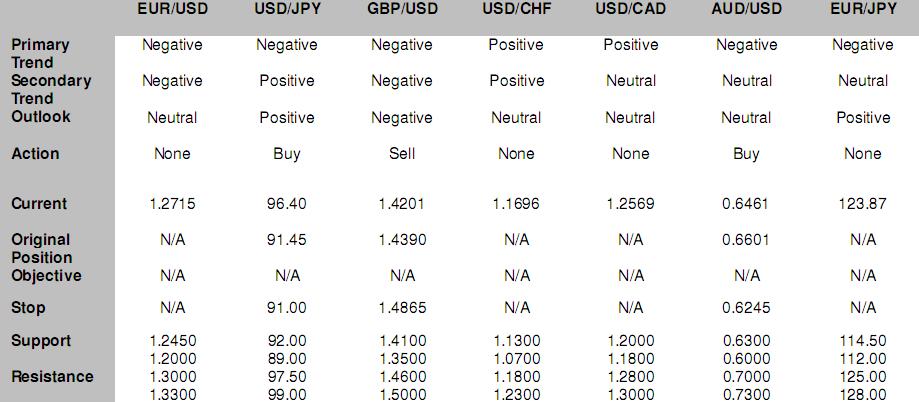

* The dollar gained against other major currencies on Wednesday as risk aversion returned to the market. US existing-home sales dropped to the lowest pace since 1997 and home prices fell to the 2003 level. President Barack Obama gave an inspiring speech last night but had few fresh ideas on how to solve the economic crisis. US stocks fell but remained about the lows set on Monday, trying to find support. The yen fell as Japanese exports plunged in January in another sign of a deepening contraction. The euro declined on increased risk aversion and plummeting German exports. Despite a 5.5% jump in crude oil prices, the USD/CAD rose after hitting the diagonal support from the short-term uptrend that started in January. The Australian dollar fell, approaching important support.

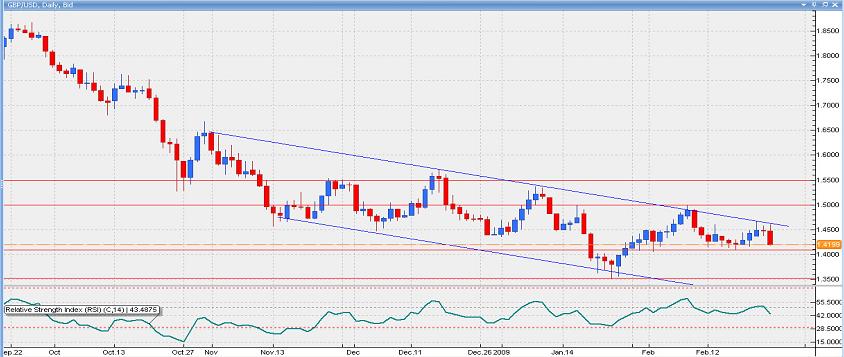

* The GBP/USD plunged as UK Q4 2008 GDP contracted the most since 1980 and Bank of England MPC member David Blanchflower said the UK recession may intensify significantly. “I expect the first quarter to be worse than the fourth, probably significantly worse,” Blanchflower said. The GBP/USD has been pressured by concerns about the solvency of the UK banking system. European Union officials have voiced concern that the pound’s slide could destabilize the UK economy, and hurt European exports to the UK. However, it is unlikely that there will be any intervention to support the pound as the BOE is talking about quantitative easing. The GBP/USD is in a downward sloping trading channel and likely to test the January 23 low of 1.3502. There are support at the 1.41 handle and resistance from the upper trading band in the 1.46 area.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US existing-home sales unexpectedly declined 5.3% m/m to a 4.49 million annual pace in January, the lowest rate since July 1997, following December’s 4.74 million annual rate, the National Association of Realtors said. The median home price fell 14.8% y/y to $170,300 in January, the lowest since March 2003. Existing-home sales fell 8.6% y/y. Inventories of previously owned homes declined 2.7% m/m at the end of January to 3.6 million available for sale, which represented a 9.6-month supply at the current sales pace, following a 9.4- month supply at the end of December. Existing home sales, while not changing in the West, fell 14.7% m/m in the Northeast, 5.7% m/m in the Midwest, and 5.7% m/m in the South.

www.cmsfx.com

Europe

* Germany’s GDP contracted a seasonally adjusted 2.1% q/q in Q4 2008, the third consecutive quarterly decline and the biggest since Q1 1987, driven by falling exports, the Federal Statistical Office confirmed. The economy shrank 1.7% y/y when adjusted for calendar effects. Exports fell 7.3% q/q in Q4, while imports decreased 3.6% q/q.

* The UK’s GDP contracted 1.5% q/q in Q4 2008, the most since 1980, according to preliminary data from the Office for National Statistics. Private consumption declined 0.7% q/q, the most since 1991, while fixed investment fell 2.3% q/q. The economy shrank 1.9% y/y, as forecast. Exports declined 5.5% q/q in Q4 after an upwardly revised 0.5% q/q increase in Q3, while imports fell 5.9% q/q following a downwardly revised 0.3% q/q increase.

www.cmsfx.com

* UK services activity declined 0.9% in the three months to December after a downwardly revised 0.5% decline in the previous period, the Office for National Statistics reported.

Asia-Pacific

* Japan’s exports plummeted 45.7% y/y and imports dropped 31.7% y/y in January as the global recession reduced demand for the exports and the domestic severe contraction reduced the imports, data from the Finance Ministry showed. Exports to the US dropped an unprecedented 52.9% y/y, and exports to Asia and Europe also recorded the largest drops. The trade deficit widened to ¥952.6 billion ($9.9 billion) in January, the biggest since comparable data began in 1980, from December’s revised ¥322.3B billion. The adjusted trade deficit widened to ¥364.9 billion from December’s revised ¥214.2 billion. With exports plunging, the Japanese economy will likely remain in a severe state in H1 2009.

www.cmsfx.com

* Japan’s small business confidence remained near a record low in February amid a deepening recession, with the sentiment index increasing to 25.0 from January’s 24.8, the lowest since records began in February 1985, Shoko Chukin Bank reported.

* Australian wages growth unexpectedly accelerated to 1.2% q/q in Q4 2008 from an upwardly revised 1.0% q/q in Q3, Westpac Banking Corporation reported. The Q4 wage cost index rose 4.3% y/y after Q3’s 4.1% y/y advance. The figures support the case for the Reserve Bank of Australia to slow the pace of interest-rate cuts.

* Australia’s construction work done unexpectedly increased 1.7% q/q in Q4 2008, according to the seasonally adjusted estimate by the Australian Bureau of Statistics, following Q3’s upwardly revised 5.5% q/q rise. Construction work done in Q4 rose 13.0% y/y.

FX Strategy Update

Hans Nilsson and Winnie Tapasanun

New York, February 25, 2009, 16:46 EST

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C

Источник: Hans Nilsson

25.02.2009

Динамика валютных курсов

Динамика валютных курсов