Risky Assets and Currencies Find Support

* he dollar and yen fell on decreased risk aversion as US stocks rallied on Wednesday. The Standard & Poor’s 500 index rose to 713 after yesterday’s close below 700 for the first time since October 1996. US economic data were still gloomy. The Fed’s Beige Book showed the US economy “deteriorated further” as consumer spending slumped and manufacturing output fell, with no turnaround expected any time soon. The US ISM non-manufacturing index fell in February and ADP predicted the steepest private sector job loss since 1949. The yen dropped to the lowest level since November 5. The euro advanced after testing the 1.24-area support overnight. The European Central Bank is expected to cut its benchmark interest rate 50 basis points tomorrow, to a record 1.50%, the lowest level in the EMU’s 10-year history. Sterling rose after bouncing off the 1.40 support. The Bank of England is expected to cut its key rate 50 basis points to 0.50% and embark upon unconventional easing policies. Commodity prices rose on hopes a new Chinese stimulus package will spurt growth. The Canadian dollar rose on higher commodity prices as the CRB index climbed over 3%.

* The AUD/USD rose today on increased risk appetite as US stocks rallied. The pair fell overnight as Australia’s Q4 2008 GDP unexpectedly contracted for the first time in eight years as exports and housing slumped, increasing pressure on the Reserve Bank of Australia to resume cutting interest rates. The plunging Australian services PMI also pressured the AUD/USD overnight; however, increased risk appetite reversed the overnight decline. The Australian dollar is trying to form a bottom, following nearly 35% depreciation since the summer. The AUD/USD is at an interesting technical area. There is support from the lower band in the upward sloping trading channel that goes back to October’s low as well as resistance from the downtrend since last summer. If this downtrend is broken, the AUD/USD will rally strongly.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US services industries remained in a contractionary state in February, with the US ISM non-manufacturing index declining to 41.6 from January’s 42.9, according to the Institute for Supply Management. The business activity index decreased to 40.2 in February from 44.2 in January and the new orders index declined to 40.7 from 41.6. The employment index increased to 37.3 in February from 34.4 in January. The prices paid index rose to 48.1 from January’s 42.5, continuing the bounce from December’s record low of 36.1.

www.cmsfx.com

* Private sector payrolls dropped a larger-than-expected 697,000 in February, according to a forecast by the ADP Employer Services, following a revised decline of 614,000 for January.

www.cmsfx.com

* Today’s US economic data indicate Q1 2009 US GDP contraction may be at least as large as Q4 2008’s 6.2% annualized decline. The job figures reinforce forecasts for a Labor Department employment report this Friday to show February payrolls dropping approximately 650,000, the most since 1949, and the unemployment rate surging to 7.9%, the highest since 1984, from January’s 7.6%.

Europe

* Eurozone services industries shrank at a record pace in February amid an intensifying recession, with the eurozone services PMI falling to 39.2, according to final PMI data by Markit Economics, following January’s 42.2. The manufacturing PMI fell to 33.5 in February from 34.4 in January. The composite PMI fell to 36.2 from 38.3.

* Germany’s services sector contracted further in February, with the German services PMI dropping to a record low of 41.3, final PMI data by Markit Economics showed, following January’s 45.2.

* The contraction in the UK services sector slowed its pace in February, with the UK services PMI unexpectedly increasing to 43.2 from January’s 42.5, its third increase since November’s record low of 40.1.

* UK consumer confidence improved slightly in February, with the UK consumer sentiment index increasing to 43; however, remaining near January’s 41, the lowest ever recorded since 2004, according to Nationwide Building Society.

* UK shop prices rose 1.2% m/m in February, driven by rising food prices, following a 0.2% m/m increase in January, the British Retail Consortium reported. Shop price inflation accelerated to 1.9% y/y, following January’s 1.1% y/y. The trend of easing inflation has begun to reverse itself, the BRC said.

Asia-Pacific

* Australia’s GDP unexpected contracted 0.5% q/q in Q4 2008 after a 0.1% q/q increase in Q3, the Australian Bureau of Statistics reported. Australian Q4 GDP growth grew at 0.3% y/y to complete 17 years of expansion; nevertheless, less than expected and slowing from Q3’s 1.9% y/y. RBA Assistant Governor Malcolm Edey said the Australian economy faces more “short-term weakness.” The economic fundamentals support the likelihood of further Reserve Bank of Australia interest-rate cuts, from the current 45-year low of 3.25%.

www.cmsfx.com

* Australia’s services sector remained in a deep contraction in February, with Australia’s AIG performance of services index dropping to 32.2 from January’s 41.0.

* China’s manufacturing PMI increased for a third month in February on a 4 trillion yuan ($585 billion) stimulus package, rising to 49.0 from January’s 45.3; however, remaining below the 50 reading indicating a manufacturing contraction, data from the China Federation of Logistics and Purchasing showed.

* China’s Premier Wen Jiabao will announce a new stimulus package tomorrow in his annual address to the nation’s legislature, former statistics bureau head Li Deshui said.

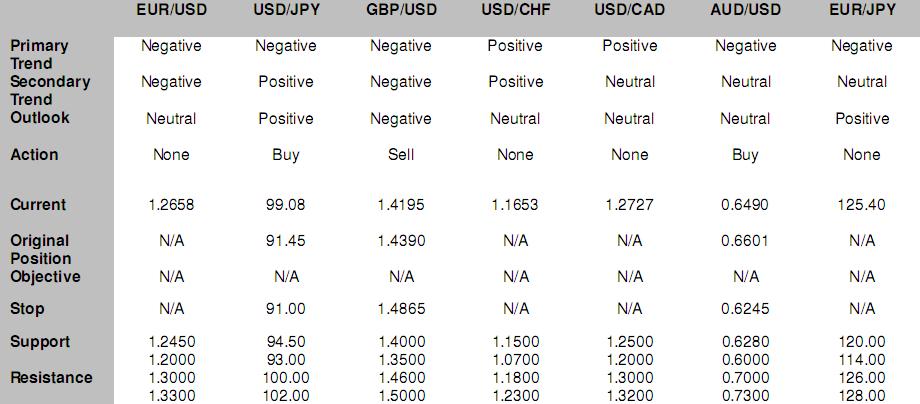

FX Strategy Update

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

Источник: Hans Nilsson

04.03.2009

Динамика валютных курсов

Динамика валютных курсов