Dollar and Yen Surge as Deflation Pressures Increase

* The yen and dollar surged while stocks, commodities, interest rates and gold prices fell on Thursday. The EMU sovereign debt risk for the southern members continued to rise. US initial jobless claims unexpectedly rose and rumors of sharp downward benchmark revisions in Friday’s employment report also increased risk aversion. The rising dollar is aggravating the already serious debt deflation problem and threatening the global economic recovery at the 11-month improvement in asset prices. The Federal Reserve should supply more dollars as the appreciating dollar increases deflationary pressures. The S&P 500 declined 34.17 to 1,063.11 and broke important support in the 1070 area. The yen surged against all major currencies, supported by carry trade unwinding. The euro fell below the 1.38 handle for the first time since June amid ongoing concerns about the fiscal stability in the PIGS counties. The European Central Bank left its key interest rate unchanged at 1.00%, as expected. ECB President Jean-Claude Trichet said it was the responsibility of every member government to get their borrowing levels under control as escalating debt levels are adding a burden onto monetary policy. The Australian and Canadian dollars fell as commodity and asset prices plunged.

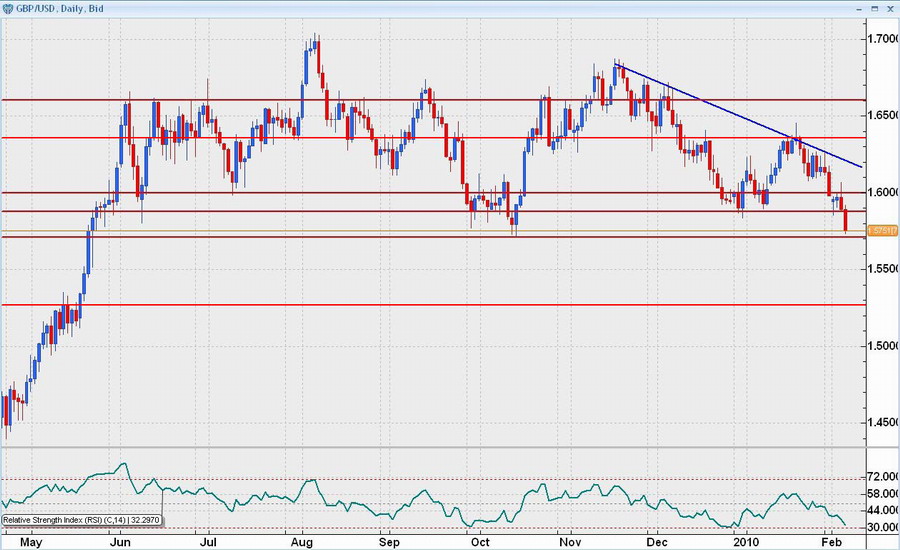

* The GBP/USD fell sharply and broke the 1.59 support. The Bank of England maintained its benchmark interest rate at 0.50%, as forecast, and voted to pause its bond buying program. However, the BOE left the door open for further quantitative easing measures should the UK economy worsen. There is minor support in the 1.57 area. If this support is broken, the GBP/USD may plunge to 1.53.

Financial and Economic News and Comments

US & Canada

* US initial jobless claims in the week ending January 30 unexpectedly increased 8,000 to 480,000, the highest level in seven weeks, from the previous week’s upwardly revised 472,000, according to figures from the Labor Department. The 4-week moving average rose 11,750 to 468,750. Continuing claims in the week ending January 23 increased 2,000 to 4,602,000 from the preceding week’s downwardly revised 4,600,000. The 4-week moving average of those continuing claims fell 51,250 to 4,617,500. The insured unemployment rate for the week ending January 23 was unchanged at 3.5%.

2_4_2010_IMG2

* US nonfarm productivity rose at a 6.2% q/q annualized rate in Q4 2009, the strongest performance in six years, after rising at a downwardly revised 7.2% q/q pace in Q3, according to preliminary Q4 data from the Labor Department. Nonfarm productivity rose 5.1% y/y. Real compensation per hour in the nonfarm sector declined at a 1.9% q/q annualized rate in Q4, but increased 0.7% y/y. Unit labor costs fell at a 4.4% q/q annualized rate in Q4 after declining at a revised 1.5% q/q pace in Q3. Unit labor costs decreased 2.8% y/y.

* US factory orders were up a more-than-expected 1.0% m/m in December, a fourth consecutive monthly gain, to a seasonally adjusted $370.4 billion, after a downwardly revised 1.0% m/m increase in November, data from figures from the Commerce Department showed, indicating the US manufacturing sector is steadily recovering. Excluding transportation, factory orders gained 1.2% m/m. December factory orders rose 3.4% y/y.

* Canadian seasonally adjusted building permits increased a less-than-expected 2.4% m/m in December to C$6.16 billon ($5.79 billion), after a revised 3.2% m/m decline in November, according to data from Statistics Canada. The December increase was led by a 6.8% m/m gain in non-residential permits to C$2.29 billion, while residential permits slipped 0.1% m/m to C$3.88 billion, the first decline in five months. December building permits jumped 32.6% y/y.

* Canada’s Ivey PMI increased less than expected to 50.8 in January from 48.4 in December, indicating purchases in Canada’s public and private sectors were higher than the prior month, according to data from the Richard Ivey School of Business and the Purchasing Management Association of Canada.

Europe

* Germany’s seasonally adjusted manufacturing orders unexpectedly declined 2.3% m/m in December after an upwardly revised 2.7% m/m gain in November, according to data from the Federal Ministry of Economics and Technology. December manufacturing orders rose a non-seasonally adjusted 8.4% y/y, a second consecutive year-on-year gain since April 2008, following an upwardly revised 4.5% y/y November advance.

* UK house prices grew 0.6% m/m in January, a seventh consecutive month-on-month gain but the lowest during this period, to an average of £169,777 ($270,565), after a downwardly revised 0.8% m/m increase in December, a Halifax report showed. January house prices rose 3.6% y/y, a third straight year-on-year rise since February 2008. House prices climbed 3.6% y/y in the three months through January, a second consecutive gain and the largest since February 2008, following a 1.1% y/y increase in the three months through December.

* Switzerland’s trade surplus unexpectedly narrowed to CHF1.36 billion ($1.28 billion) in December from a downwardly revised CHF1.98 billion in November, according to figures from the Swiss Federal Customs Administration.

Asia-Pacific

* Australian retail sales unexpectedly fell 0.7% m/m in December, the first fall in five months, to a seasonally adjusted A$19.93 billion ($17.57 billion), after an upwardly revised 1.5% m/m gain in November, according to figures from the Australian Bureau of Statistics (ABS). December retail sales rose 3.0% y/y nsa.

* Australia’s seasonally adjusted building approvals unexpectedly increased 2.2% m/m to 14,869 in December after an upwardly revised 10.4% m/m rise in November, data from the ABS showed. December building approvals jumped a more-than-anticipated 53.3% y/y, following an upwardly revised 40.5% y/y November gain. Approvals to build private houses grew 3.1% m/m to 9,682 in December and climbed 39.5% y/y. Approvals for apartments and renovations rose 9.1% m/m to 3,919 and jumped 56.9% y/y.

* The Australian Industry Group/Housing Industry Association performance of construction index rose to 57.7 in January from 49.3 in December, indicating Australia’s construction sector expanded to the highest level since January 2008, according to an AiG/HIA report.

Источник: Hans Nilsson

04.02.2010

Динамика валютных курсов

Динамика валютных курсов