The Impact on Rising Commodities

The weekend papers were filled with reports about rising commodity prices and the inflation fears this sparked in both emerging markets and major markets like Europe and the UK.

Apart from the obvious social and economic impact of rising commodity prices, there are some interesting correlations that traders should also be aware of.

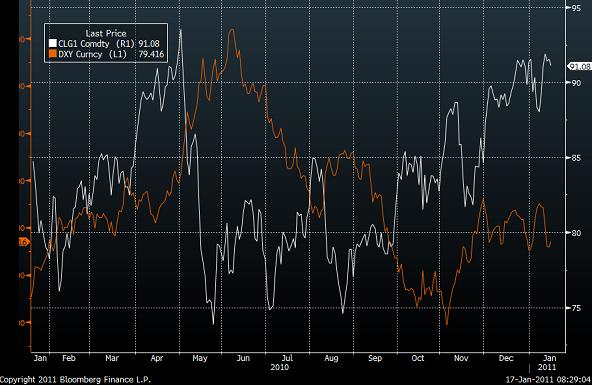

For example, oil and the dollar. WTI crude rose above $90 per barrel last week which coincided with a 2 per cent fall in the dollar index - the dollar measured against its major trading partners. Since oil is priced in dollars, when the dollar falls oil rises and vice versa. This relationship has persisted for some time, and is fairly well known. It is thought that macro traders and hedge funds plug this relationship into their trading models, so when the dollar falls they buy oil and likewise they sell the commodity when the dollar rises.

The chart below shows the extent of the negative correlation between oil (white line) and the greenback:

So what is the relationship between stocks and rising commodity prices?

So far rising commodity prices have coincided with a rise in equities. The chart below shows the Thomson/Jeffries commodity index (white line) along with the MSCI emerging markets index (orange line) and the S&P 500 (green line). As you can see they have moved together extremely closely in the past year, especially since November 2010.

Why is this?

Both commodities and stocks are risky assets, so it makes sense that stocks and commodities rise together when we are in a risk-seeking environment. Also, stock indices like the UK’s FTSE 100 contain a large energy sector, which gains when commodity prices rise.

But there are times when rising commodity prices have not been followed by an increase in stock indices. Back in May 2008, stocks peaked, while the commodities index carried on reaching fresh highs for a further month until the end of June.

There is also the risk that higher commodity prices erode corporate profitability through 1, higher costs and 2, if consumers are spending more on necessities like gas and food they may have less to spend on other more discretionary items.

However, commodities remain well below their 2008 peak and so far 2010 corporate earnings do not seem to have been adversely affected by the rising price of food stuffs and raw materials. This suggests that the positive relationship will last for a while yet.

But remember the positive stock/ commodity relationship may fall apart and if there is an external economic shock (say a Eurozone sovereign default, flight from US assets on debt concerns etc) then stocks could come off sharply before commodities due to supply/ demand concerns that allow commodities to continue to rise after stocks peak.

Источник: FOREX.com

17.01.2011

Динамика валютных курсов

Динамика валютных курсов