Is the euro decoupling from the debt crisis?

The peripheral debt crisis:

The euro has made an impressive come-back after faltering at the start of the week. Yesterday the single currency rose nearly 2 per cent, which leaves a breach of 1.3500 in view that would herald more gains.

Interestingly, this has come at the same time as EU leaders have failed to come up with a credible long-term solution to the sovereign debt crisis , instead holding off on any decisions to extend the EFSF rescue fund until March, with a fresh round of bank stress tests not due until July.

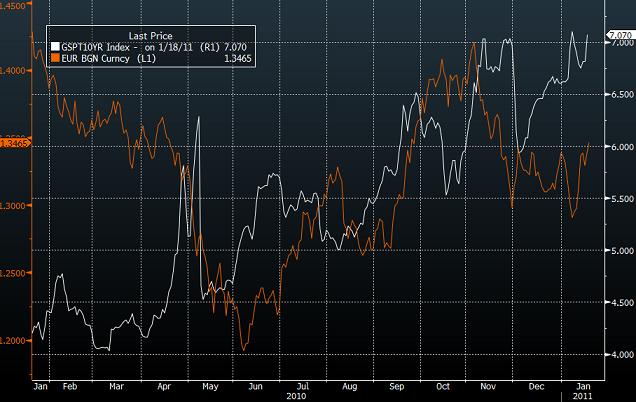

Interestingly, EURUSD has been rallying at the same time as Portuguese bond yields have risen above the crucial 7 per cent level that is deemed the threshold whereby Portugal would require a bailout, as you can see in the chart below. Yields and the euro moved in the same direction until the end of last year, when Portuguese yields rose as the euro sold off. Since then yields have risen as the euro has fallen as investors sold the single currency on the back of sovereign debt fears.

EURUSD (orange line) and 10-yr Portuguese government bond yields

So why is the euro rising at such a critical time for the Eurozone?

There are three reasons for this:

Firstly, most risky assets are rallying. Stocks are at a cyclical high and this is dragging the euro ( part of the risky FX pack) higher. The bullish atmosphere in the stock market is dominating investor sentiment so that fears about a potential bailout of Portugal have taken a backseat.

Secondly, Germany’s economic rebound is continuing into the new year. Yesterday we saw strong investor confidence. The forward looking component of the ZEW index rose to a 5 month high, smashing market expectations. Germany is the largest economy in the currency bloc, so its strength will boost Eurozone economic data in the first quarter. The fact that the euro staged a strong rally post the strong ZEW figure yesterday suggests that the euro is trading like the Deutschmark.

Lastly, part of the euro’s strength could be down to investors clinging to hope that the Eurozone’s leaders can find a solution to this crisis. Although there will not be an immediate boost to the EFSF fund, or the introduction of euro-wide bonds, which are considered by many to be the only way out of this crisis, investors are still giving the currency bloc the benefit of the doubt and expect it to muddle through to a solution at some point this year.

Even if the general trend is higher for the single currency, it may be a bumpy road ahead due to the ongoing threat of a sovereign crisis shifting investor sentiment. Above 1.3500, the next key resistance level is 1.3685, then 1.3980 – 200-week moving average, before 1.40. Below 1.3500, 1.3415/20 should hold as good resistance if the euro’s upward trajectory is to be maintained.

Источник: FOREX.com

19.01.2011

Динамика валютных курсов

Динамика валютных курсов