Japan's downgrade is a warning shot

Japan’s credit rating gets cut by a large credit rating agency, causing investors to rush to safe havens. The dollar gets a boost

• But unanimous Fed decision last night, reaffirms the Fed’s commitment to further QE

• Even though the UK economy stalled in Q4, traders are pricing in rate hikes from the Bank of England as early as next month!

Japan:

The credit crisis that has consumed peripheral Europe for the past year, might be shifting to other indebted nations around the world. Today Japan’s credit rating was cut by one notch to AA- with a stable outlook, due to Japan’s lack of a credible fiscal strategy. This makes the reigning DPJ’s plans to implement a controversial sales tax even more urgent to try and being down its massive public debt, which is currently at 200 per cent of GDP.

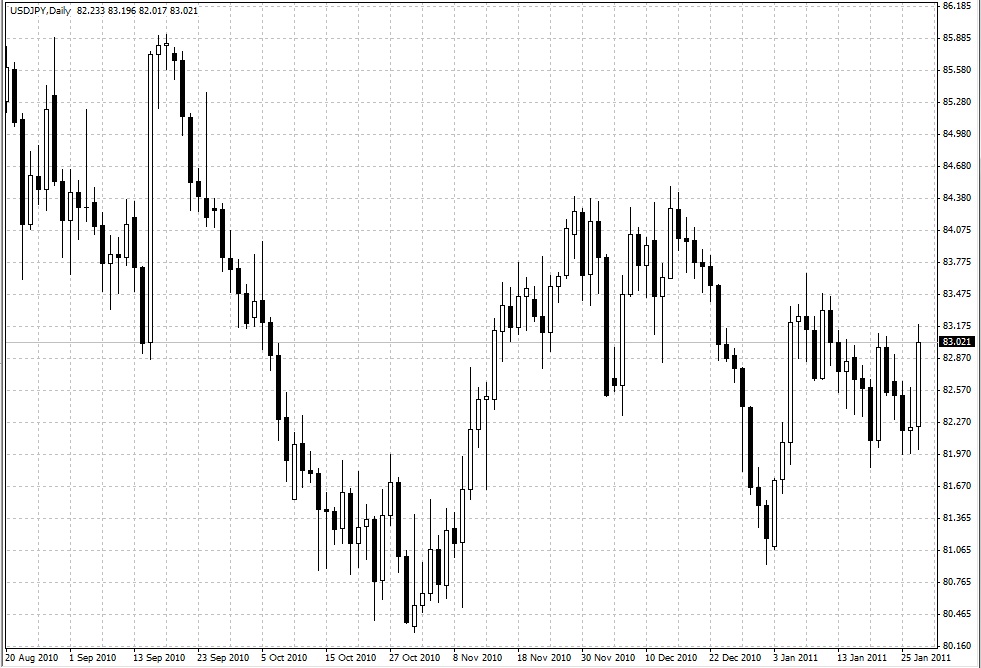

What is the impact on the yen? While the initial “shock” of the downgrade caused a flight out of the yen and a move into the relative safety of the dollar, USDJPY hasn’t so far been able to sustain gains above 83.00, likewise, EURJPY initially spiked, but has failed to break above 113.50.

Although today’s move is a warning signal that debts of western nations remain a bigger issue than just peripheral Europe, Japan’s debt is held mostly by domestic investors, which should protect it from a sharp sell-off anytime soon.

Thus, the yen sell-off may also prove to be short-lived.

Federal Reserve: No hawks?

The FOMC statement last night was as expected, except that none of the new members picked up the baton from hawk Hoenig and there were no dissenters.

• The Committee confirmed that the economic recovery is continuing

• The improvement in the unemployment rate and core inflation have been “disappointingly slow.”

• The Fed remains committed to QE2 until June this year

• Current economic conditions “are likely to warrant exceptionally low levels for the federal funds rate for an extended period.”

• No one voted against the policy decision after prior hawk Hoenig left the FOMC at the start of this year.

Depending on the GDP data tomorrow, which is expected to show growth accelerated to 3.5% annual pace in Q4 last year, we have a dovish Fed implementing more policy stimulus at the same time as growth has returned to pre-recessionary levels... we’re live in a strange new world...

But dollar strength might prevail for a little while after markets were shocked by the downgrade of Japan.

UK: investors are pricing in a nera-term rate hike after January’s meeting showed a more hawkish split in the voting.

Interest rate futures contracts (short sterling) have fallen (yields risen) in the aftermath of yesterday’s BOE minutes. The chart below shows the March Short sterling contract. This is currently pricing yields at 83 basis points, this equates to the markets expecting one 25 bp hike during the next two months. The moving average for the short sterling yield chart has also turned sharply higher, which reinforces the trend amoung traders to price in a near-term hike.

27.01.2011

Динамика валютных курсов

Динамика валютных курсов