Egypt Unrest Hurts Risk

Risk aversion took the markets by storm to begin the week as political unrest in Egypt has sent investors looking for safe haven currencies. The protests and higher body count in Egypt that currently show no signs of resolution have markets fearing the unrest could spread across the middle east, pushing traders to flee riskier assets and seek the perceived safety of the yen, Swiss Franc and US Dollar. The fear caused a gap on the currency open, with the EUR/USD opening about 25 pips lower near 1.3585 and the AUD/USD opening near .9890, almost 50 pips lower than Friday’s close. As traders recently feared sovereign debt contagion among EU nations, the fear is now a political unrest contagion that could have the likes of Saudi Arabia in its cue with Tunisia and Egypt already victimized.

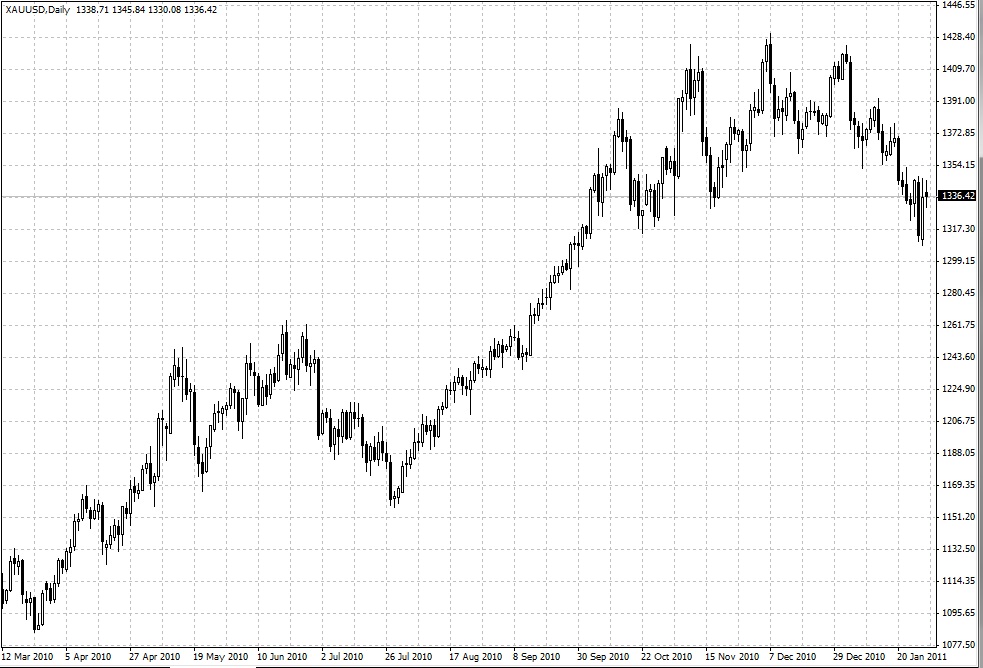

With the lows in the EUR/USD near 1.3570, the pair was able to catch eventual bids to 1.3610 late in the day. The same was witnessed for the AUD/USD as the pair added over 65 pips to 0.9950 by days end fueled by higher equities and commodities across Asia. While XAU/USD saw highs over $1345.00, the move turned and saw late day prices closer to $1330.50.

BCO/USD flirted with the $100 per barrel level as fear of an unstable shipping passage in the Suez Canal put fear in traders.

Elsewhere USD/JPY remained steady while the yen crosses traded sideways after a lower open as traders leaned toward the yen. GBP/USD found the momentum to crawl higher on the day from 1.5820 to 1.5880 while EUR/CHF found an almost two week low of 1.2780 on the flight to safety.

The current political unrest in Egypt should dominate the moves in currencies for the near term, as there is an absence of any top tier data ahead until tomorrow’s Australian rate decision.

Источник: FOREX.com

31.01.2011

Динамика валютных курсов

Динамика валютных курсов