Markets Eye Inflation

With recent geopolitical issues pushed to the background, inflation has been the new fuel that has moved markets here in Asia. Although the political unrest in Egypt has not abated, it has not escalated either, thus helping to pull the crisis out of the spotlight at least for the time being. Developments in that region over the next few days will be pivotal for the Middle East and will surely thrust Egypt back onto center stage, be it for better, or for worse. In the mean time the markets are focused on inflation it would seem. Yesterday’s CPI data out of the EU, (in line at 2.4%) in conjunction with ECB President Trichet’s recent hawkish ramblings have escalated hopes for a rate hike in the Euro Zone, helping to keep the EUR/USD just off of recent two month highs.

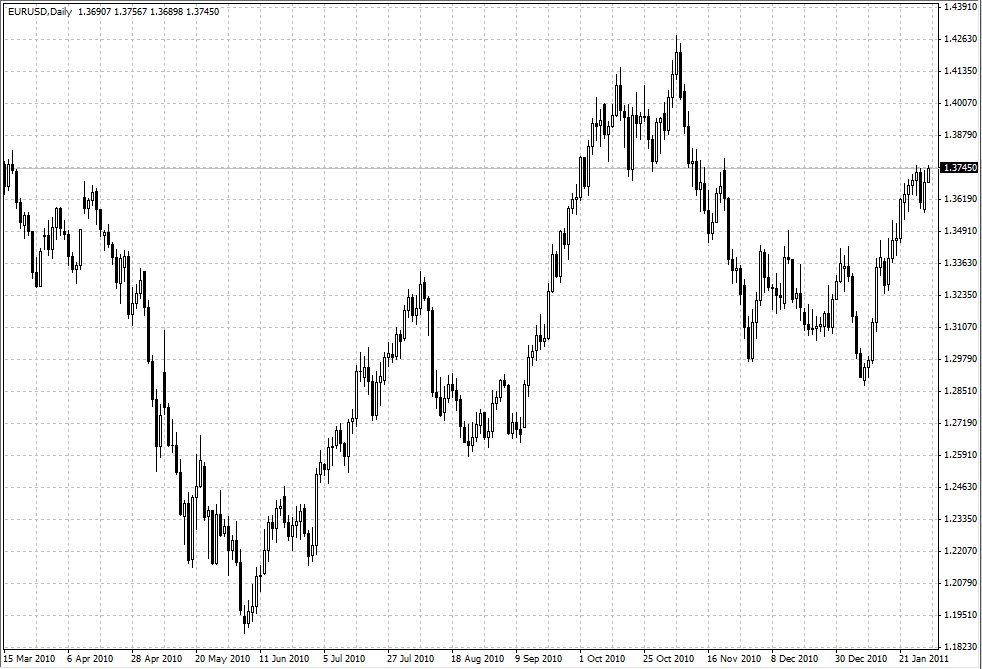

The EUR/USD, which traded between 1.3690 and 1.3730 on the day, remained within striking distance of recent two month highs just near 1.3757.

A similar story was seen in the GBP/USD where higher inflation has prompted many to surmise that a rate hike was in the cards for the first part of the year. The theory helped push the GBP/USD through stops near 1.6030 as the pair completed a 65 pip gain on the session to highs near 1.6075.

Early short covering in the AUD/USD saw moves above parity prior to the RBA rate decision. Although the Central Bank kept rates unchanged at 4.75% as expected, the following communiqué was more upbeat than anticipated ultimately pushing the AUD/USD to highs over the 1.0035 mark. US Dollar weakness played a part today as well, with USD/JPY sliding from 82.10 to 81.75 and USD/CHF from 0.9435 to lows near .9410. A softer dollar sent gold higher as XAU/USD posted $7 gains to highs just above $1339.00. BCO/USD remained flat lined near $100.50 per barrel after dropping over a dollar from late New York trading.

Ahead in the London markets we’ll see a good deal of data with UK Nationwide HPI and Manufacturing PMI, Swiss Retail Sales, and Unemployment data from Germany, Italy and the EU.

Источник: FOREX.com

01.02.2011

Динамика валютных курсов

Динамика валютных курсов