Markets ride wave of euphoria

Financial markets are completely calm about political events in the Middle East, growth in the UK and sovereign debt problems in Europe; at least that is what the price action of stocks seems to be telling us. The Dow Jones Industrial Average and the S&P 500 both closed at multi-year highs yesterday at 12,000 and 1,300 respectively. These were key resistance levels and suggest further gains ahead, although a period of consolidation might be due first so that investors can take a breath before embarking on another push higher. The global economy appears to be in a sweet spot at the moment, with the recovery in the developed world gaining traction as yet unimpeded by $100 per barrel oil, and monetary policy is still loose. The next question investors will need to ponder will be the effects of global central banks removing the punch bowl from this party, but that isn’t on the agenda for today and risky assets are firmly in favour.

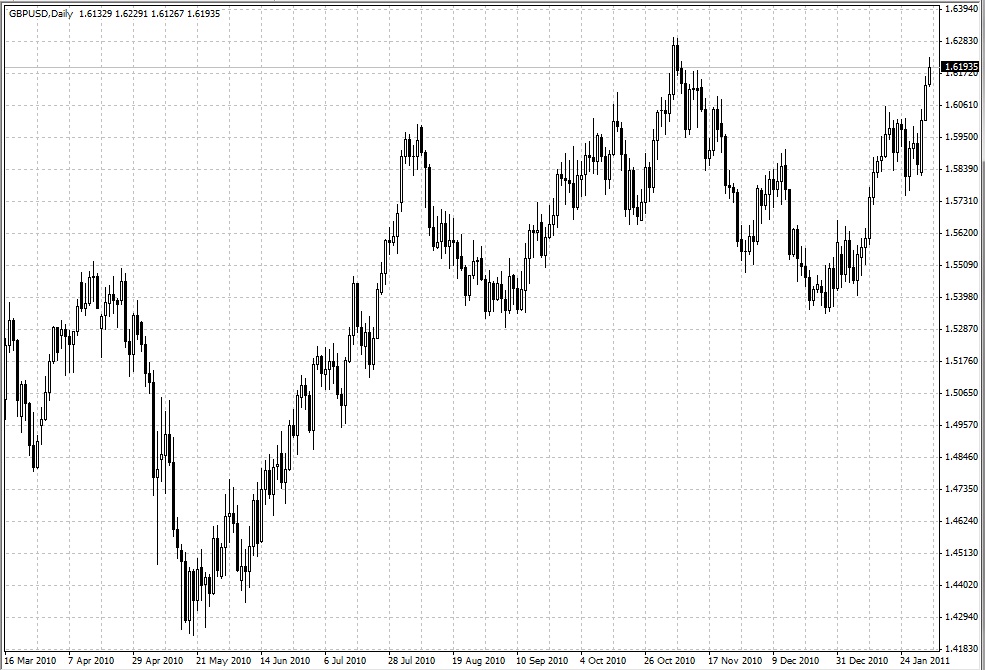

In contrast, the dollar is being sold off across the board. It is close to multi-year lows versus the Swiss franc and is hovering below 81.50 versus the yen. EURUSD is above 1.3800 and GBPUSD is up above 1.6200, after a mixture of a strong construction sector PMI reading out of the UK along with a more general bearish move for the dollar helping to break through this key psychological level of resistance.

Sovereign debt concerns are also being put on the back burner. EU President Herman Von Rompuy said this morning that a “comprehensive” plan to enhance the support package for EU members in financial troubles will be announced at the EU summit in March. The Eurozone authorities seem to have finally got the hang of an effective communications strategy, and this has paid off. The market doesn’t like to be shocked, the steps taken to prepare the market for what is coming - most likely an increase to the EFSF rescue fund, possibly a change in the terms of bailout loans to Ireland and Greece and maybe even a bailout for Portugal – are being rewarded by the market. Bond yields on Europe’s peripheral debt have retreated. The cost to insure the debt of these nations has also started to fall. For example, the Credit Default Swap rate for Spain has dropped by 140 basis points since reaching a peak earlier this month of 360 basis points. Also, Portugal had a successful auction of short-term government debt this morning. The authorities sold 6-month bills at a yield of 2.984% versus 6.686% in January.

If EURUSD can sustain gains above 1.3800, then 1.4000 is within reach. Interestingly, EURCHF has not moved higher with EURUSD. This is possibly due to USDCHF weakness, and suggests that a lot of the move in EURUSD is due to a weak greenback, not because of the improvement in the sovereign debt crisis. However, this should start to boost the euro as long as the EU authorities can agree on a package of reforms by next month.

Another data surprise in the UK sent GBPUSD soaring as the spread between 2-year UK and US bond yields rose to a 2-year high. However, EURGBP remains fairly range bound as yield is also supportive of the euro at the moment.

We are getting ready for some big data releases and an ECB meeting in the next couple of days. All eyes will be on the upcoming US ADP employment report that is due at 1315GMT. This is the precursor of Friday’s payrolls data. Another lacklustre employment report out of the US will only exacerbate the dollar’s problems. However, markets may take a breath today before reassessing their positions tomorrow and Friday. Oil remains comfortable above $101 per barrel (Brent), which leaves $110 in sight. Gold is lower, and the market will be watching to see if US stocks can extend yesterday’s strong performance.

The cyclone that is about to hit Queensland in Australia could dent sentiment toward the Aussie later in the session.

Источник: FOREX.com

02.02.2011

Динамика валютных курсов

Динамика валютных курсов