The Bernanke Effect

In a week that’s been fairly light on the data front, all eyes will be on Bernanke’s testimony to the Senate Budget Committee at 1500 GMT/ 1000 ET today.

With interest rate differentials determining market moves for the time being, investors are on central bank watch, and Bernanke’s testimony has the potential to cause a flurry of excitement in FX markets.

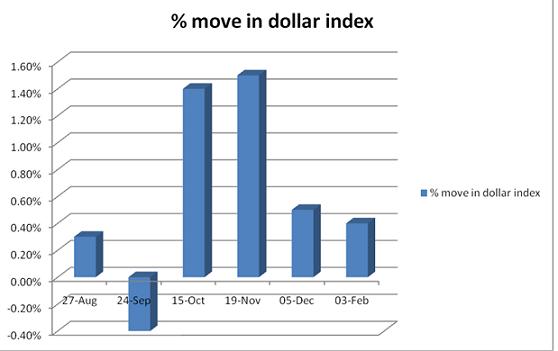

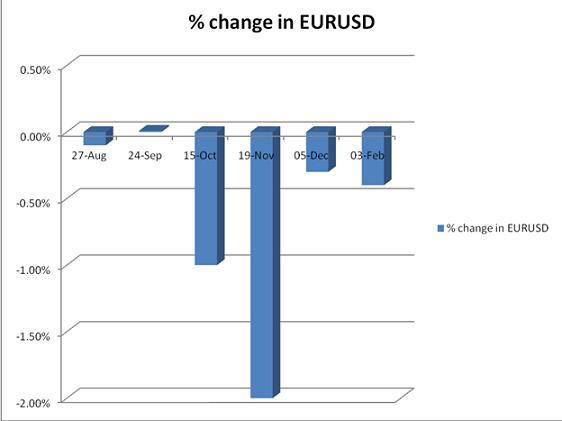

The analysis below shows the % move in the dollar index (the dollar versus the currencies of the US’s major trading partners) and in EURUSD in the two days after a major speech by Bernanke.

These are the speeches we have looked at:

Aug 27 – Bernanke speech at Jackson Hole Central Banks conference when he first touted the prospect of a second round of QE

Sept 24 – Bernanke’s speech entitled the Implications of the Financial Crisis for Economics, Princeton University

15 Oct - Monetary Policy Objectives and Tools in a Low-Inflation Environment, Federal Reserve Bank of Boston

Nov 19 – Rebalancing the Global Recover, At the Sixth European Central Bank Central Banking Conference, Frankfurt, Germany

Dec 5 – Bernanke’s appearance on CBS

Feb 3 - The Economic Outlook and Macroeconomic Policy, At the National Press Club, Washington, D.C.

Bernanke’s impact on the dollar index:

Bernanke’s impact on EURUSD:

Conclusions:

Since the end of August, Bernanke’s speeches tend to coincide with the dollar appreciating rather than falling.

Since the announcement of QE2 on November 3 2010, Bernanke’s speeches have coincided with more consistent upward moves in the dollar, on average the greenback has appreciated by 0.8%. This has also coincided with the pick- up in US growth since the Autumn.

We can make two assumptions from this:

1, Even though Bernanke continues to reference the weakness in the labour market, the market reacts more to his comments on the improving growth outlook:

His speech at the National Press Club in Washington on 3rd Feb highlights this. He said that “it will be several years before the unemployment rate has returned to a more normal level” but the bit the market latched on to was his comments on growth: “More recently, however, we have seen increased evidence that a self-sustaining recovery in consumer and business spending may be taking hold.” The dollar rose by 0.4% on the back of these comments.

2, The US dollar is increasingly showing signs that it is trading like a growth currency, and the market seems to be ruling out the prospect of further quantitative easing from the Federal Reserve.

09.02.2011

Динамика валютных курсов

Динамика валютных курсов