UK waits for inflation data

Asia just relived another slow and steady session that saw the European single currency grind higher now that a resolution between Germany and West LB bank has been hammered out. The EUR/USD saw gains from 1.3485 to an apex just over 1.3535 in Asia once the restructuring news of West LB had been digested by the markets. A fear of the bank being dismantled by the government had weighed on the Euro previously. Risk was generally in favor as a lack of top tier data and bad news helped push the yen crosses and Aussie dollar higher on the day. USD/JPY remained in a stale range barely exceeding 10 pips on the day.

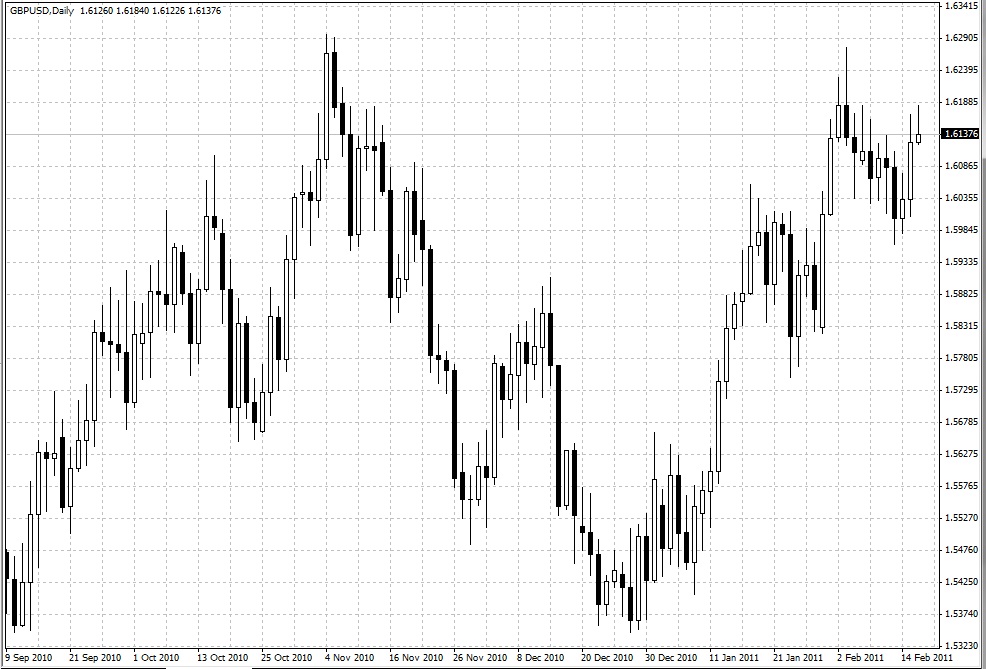

The real champion of the session was surely the British Pound however, as traders bet on higher inflation that may provoke the Bank of England to hike interest rates sooner than later. While only in a 40 pip range with a top near 1.6165, the GBP/USD pair was coiled to strike if the impending BOE inflation report due at 10:30GMT showed higher inflation than anticipated. The Pound has recently benefitted from the idea that the recent increase in UK inflation would force the hand of the BOE to raise rates. Expect sparks to fly with this pending data release.

London’s data will be dominated by the UK, with the release of claimant account data, unemployment data, and at 10:30GMT, the BOE inflation report followed by comments by Bank of England Governor Mervyn King.

Источник: FOREX.com

16.02.2011

Динамика валютных курсов

Динамика валютных курсов