Dollar Doldrums Continue

The demise of the US currency continued today in Asia as risk appetite increased due to optimistic earnings on Wall Street that seemed to reinforce the view that the global recovery is still making progress. The markets continue to overlook any bad news and buy into higher yielding riskier assets with the funding of the greenback, sending the AUD/USD, gold and silver to fresh all time highs today in what was a relaxed trading session. The swirling rumors of China possibly revaluating its currency over the weekend in order to fight inflation helped to grease the wheels of the dollar slide lower.

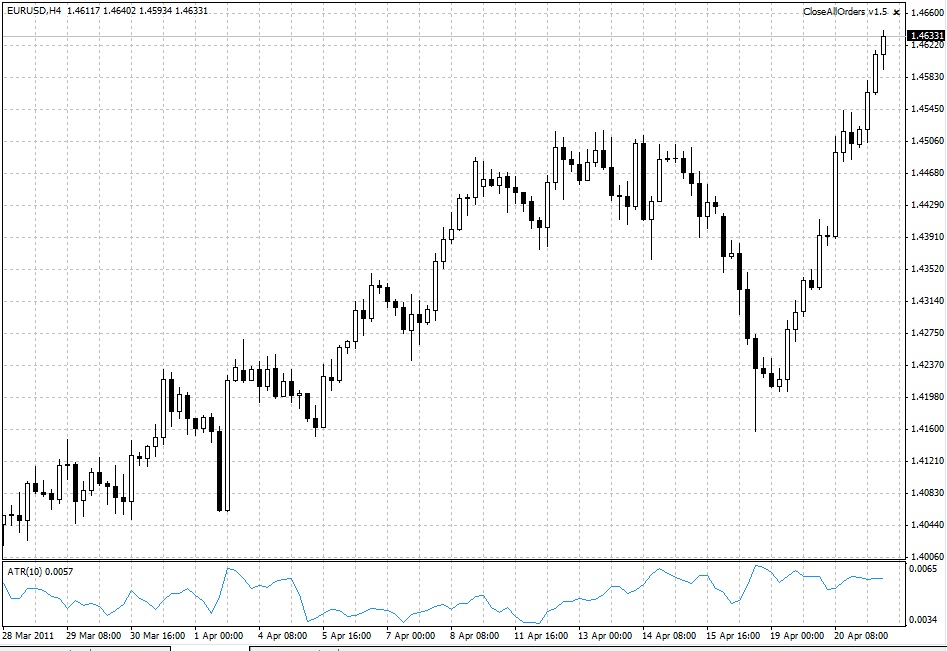

The EUR/USD took out a noted barrier at 1.4550 on a stop driven move and really hasn’t looked back as it trades near fresh highs of 1.4600 heading into the London session. The AUD/USD saw a fresh all time high near 1.0770 on the day while the Australian Foreign Minister Rudd made statements that his government is not in the business of regulating FX markets. Australian PPI was the lone piece of tier one data out today, and it came in higher at 1.2% versus the forecast of 1.0%. Not to be left out of the action, the New Zealand dollar soared to new almost three year highs of 0.8015 against the US currency. GBP/USD also impressed with gains of over 60 pips to highs just over 1.6450.

Looking at the yen, the Japanese unit firmed to its highest level of the month against the dollar as the USD/JPY dropped under the 82.00 big figure. The yen crosses were lifted by early moves in risk, but failed to have the follow-through of the majors with the yen acting as an anchor. The woes of the dollar were capped off by the new record high of gold which hit $1508.20 per ounce highs, as well as the record high of $46.00 per ounce in silver.

Ahead in the London Session we have top tier data in German Ifo and UK retail sales and public sector net borrowing. Philly Fed manufacturing data will round out the week in the New York session as many markets will be closed on Friday for the Good Friday holiday. Both Australia and New Zealand will be closed tomorrow due to holiday.

Источник: Forex.com

21.04.2011

Динамика валютных курсов

Динамика валютных курсов