A sloppy end to the week for risk

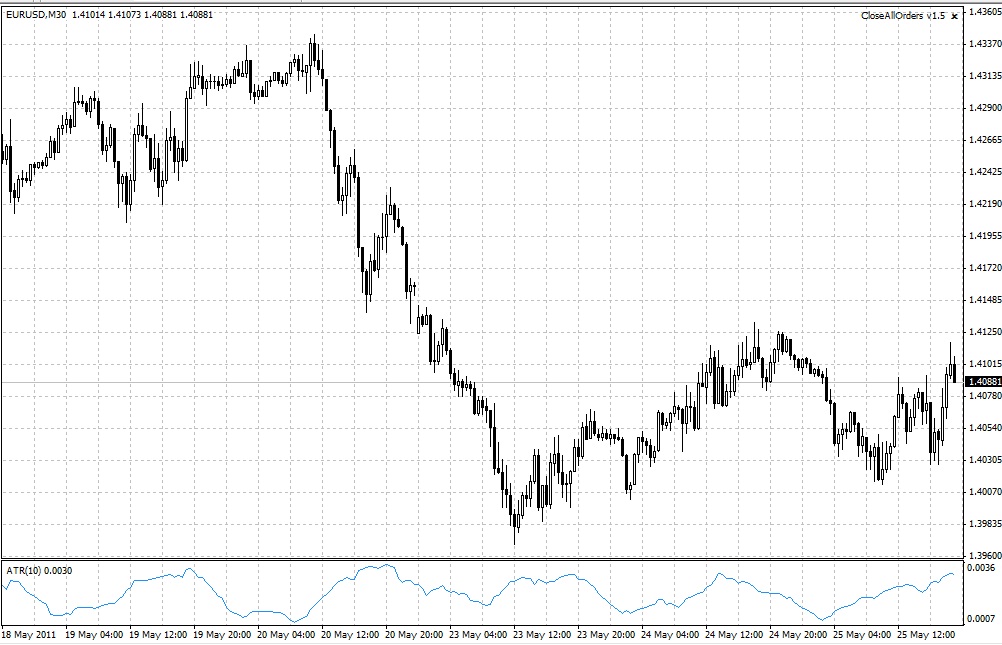

So Trichet may have signalled a rate hike next month, but investors weren’t persuaded this was the start of an aggressive tightening cycle so the euro has continued to sell off this morning. In fairness Trichet had noted earlier in the year that any normalisation in policy would be gradual and an interest rate increase would not be the start of the tightening cycle, so yet again the market got ahead of itself.

But while we think that the euro’s chances of reaching 1.5000 in the near to medium term are slim, we aren’t anticipating imminent collapse. Although the Greek crisis rumbles on, we do not expect a rebound in the dollar anytime soon. The US has fiscal concerns of its own and continued signs of a slowdown in growth, which is weighing on interest rate expectations and depressing Treasury yields – 10-year yields are still below 3 per cent - will limit strength in the buck in our opinion.

Helping to fuel interest in the euro is Germany. The largest economy in Europe is still growing strongly. The Bundesbank raised its forecast for German growth for 2011 to 3.1% from 2.5%, its prior forecast. Encouragingly, the Bank stated that domestic demand will be the chief driver of the exporting powerhouse, which is vital due to signs of a global economic slowdown that may hit demand for German-made goods. Although it revised up its 2012 forecast to 1.8% from 1.5%, it is still a fairly sharp slowdown, which goes someway to explain the cautious stance of the ECB when setting monetary policy at this juncture of the economic cycle.

The story of Greece and its never-ending round of bailouts is beginning a new chapter. The Greek parliament agreed to a fresh round of austerity measures yesterday. But the EU’s high command still can’t agree on the terms of a future bailout. German Finance Minister told the German Parliament that there will be no further aid without the participation of private creditors. This is not a solution acceptable to the ECB, who holds in excess EUR75bn of peripheral debt on its balance sheet through its Securities Markets Programme, as well as holding more Greek and Irish debt as collateral in return for loans to these nations’ troubled banking sectors. The ECB vice president Constancio said in no uncertain terms earlier today that “the burden is not on us” to solve Greece’s crisis.

None of this is helping sentiment to Europe’s peripheral credit markets. The cost to insure Greek debt against default rose to another record high and is now within reach of costing 1,600 basis points! Likewise, the spread between Portuguese and German bonds rose to a fresh record and Irish government bonds continue to see prices tumble and yields surge.

June was always going to be a pivotal month because if a fresh round of funds isn’t made available to Greece by next month if will need to default. EU heads of state meet to agree on future funds for Athens on June 24th, so expect wrangling between the various branches of EU authority and a lot of confusion until then when the hard decision has to be made. Although the edge has come off the euro, EURUSD at 1.4450 at the time of writing suggests that the market still expects a conclusion to be found.

In fact, later on this summer we may be talking about the US’s debt ceiling and its fiscal crisis rather than Greece as the spotlight shifts across the Atlantic….

The edge may come off the dollar later after 3-month US LIBOR reached a record low of 0.24850% as expectations of the Fed remaining on hold for a prolonged period.

This hit USDCAD, which is back at its lows of the day around 0.9730, after some strong Canadian labour market data suggested the economy is potentially outperforming expectations and may increase pressure on the BOC to raise interest rates. This is CAD positive.

News out of China that the trade surplus has narrowed could weigh on 2Q growth, added to that South Korea unexpectedly hiked rates today to 3.25%. This hasn’t helped sentiment towards the Aussie dollar, which is highly leveraged to growth in China and Asia.

Ahead today there is little other data of note but watch out for a speech by Fed’s Dudley at 1400BST/ 0900 ET

Источник: Forex.com

10.06.2011

Динамика валютных курсов

Динамика валютных курсов