USD at a critical juncture

‘Risk off’ seems to have gained a considerable edge in the seemingly perpetual ‘risk’ tug of war – UST yields are sharply lower, commodities ended down across the board, and U.S. equities extended their respective downtrends. However, FX movements suggest price action today is not just a ‘risk off’ move but a dollar move as well. Beta currencies are broadly lower but so are typical safe haven currencies (JPY, CHF) against the buck - part of which can be attributed to the upside U.S. May CPI surprise recording its steepest rise in 5 years at +0.3% - and sees the USD trading at critical junctures against many of its peers:

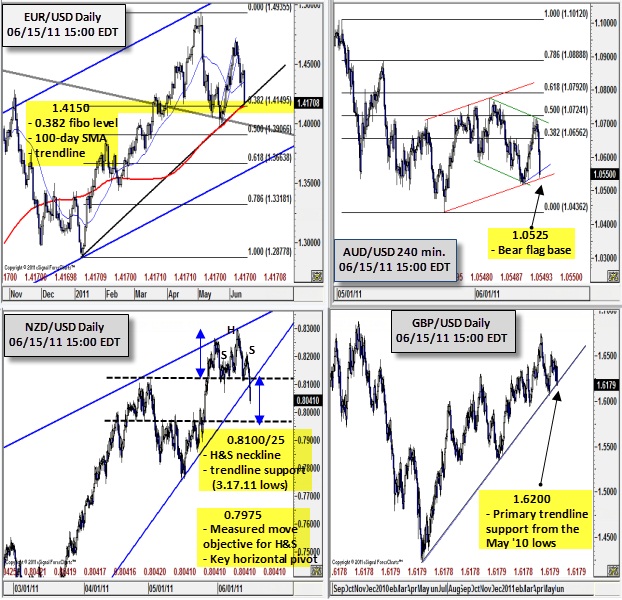

EUR/USD: 1.4150 sees converging support from the 100-day SMA, 0.382 fibo level (Jan ’11 to May ’11 ascent), and rising trendline from the 1.2860/65 Jan. ‘11 lows and has stalled further downside so far. A bounce from here sees the next meaningful resistance area into the daily cloud base around 1.4340. However, a break below 1.4150 may see extended weakness towards the psychologically significant 1.4000 figure ahead of the 1.3970 May ’11 lows.

AUD/USD: Testing bear flag support around 1.0525. A move below suggests a measured move objective towards parity while near term support comes in at the key 1.0450 horizontal pivot. Immediate resistance may be found into the hourly SMA convergence zone around 1.0650/60.

NZD/USD: Break below supportive trendline from the 0.7115/20 March ’11 suggests the kiwi may be setting up for a landing. Furthermore, the move below a potential H&S top formation projects a measured move objective to 0.7975 which appears to be the next key downside pivot ahead of 0.7825/50. Immediate resistance comes in around the broken H&S neckline around 0.8100/25.

GBP/USD: Primary trendline support from the May ’10 1.4225/30 lows comes in around 1.6175/1.6200 and has stalled downside for the time being. A firm daily close below, however, suggests the primary uptrend may be setting up for a reversal or at minimum a period of consolidation. A bounce higher, however, may meet immediate resistance into the 1.6215/25 pivot.

Источник: Forex.com

16.06.2011

Динамика валютных курсов

Динамика валютных курсов