China comes to the rescue

News overnight that China’s economy had expanded by a healthy 9.6 per cent has buoyed markets in the European session. China is growing strongly and is willing to help Europe out, there were rumours yesterday that China had started buying Italian bonds at an auction of 12-month debt, so risk is back on.

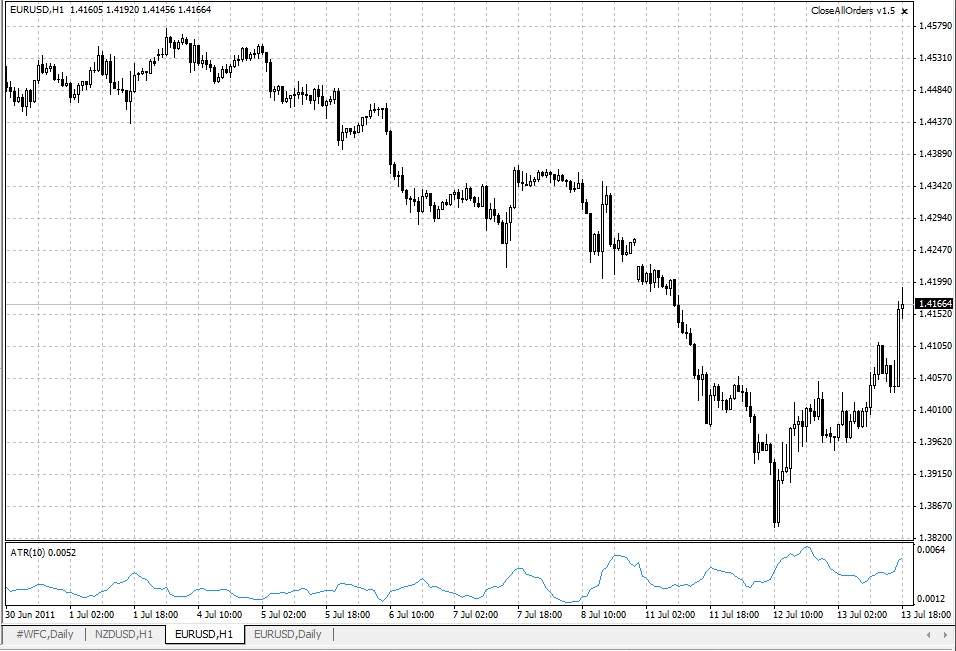

The euro has bounced back nicely after touching 1.3950 after yesterday’s news that Ireland had been downgraded to junk status by Moody’s the credit rating agency. This caused a sell-off in US stocks, but once it was digested investors reminded themselves’ that the ECB has already waived credit criteria when accepting Irish debt, so the downgrade really has no bearing on the Irish banking sector’s ability to raise funds from the ECB.

Italy is back in focus. Bank of Italy head and ECB President heir apparent Mario Draghi was speaking this morning. He announced that Italian banks will pass stress tests even though they need roughly EUR20 billion of new capital to meet Basel 3 standards for 2019. He said that banks were solid, even though some of Italy’s largest lenders have come under extreme pressure in recent days and seen their share prices plunge. This has caused a rally in the Milan stock market, which is up more than 2 per cent so far today.

This is positive news and may take the pressure off Italy in the short-term. Its bond yields have fallen sharply to 5.44% after touching a euro-era high of 6 per cent yesterday. This was helped along by a statement from Moody’s that said Italy’s debt’s maturity profile is manageable at more than 7 years. However, it warned Rome that political infighting was weighing on bond yields.

Draghi’s speech acknowledged that Europe’s sovereign debt crisis had entered a new phase. He said that the cost of funding for sovereigns will stay high and members can’t expect to share similar rates with Germany as they once did. This suggests that there has been a structural shift in Europe’s credit markets and bond yields for some member states will remain high until debt levels come down.

Calm has descended on the markets after two days of panic; however we are not out of the woods yet. Italy holds an auction of long-term debt tomorrow. It seems increasingly likely that the ECB and maybe even China will have to step in to ensure 1, the auction does not fail and 2, that yields on the bonds getting auctioned do not shoot sky high.

Added to this, the rest of Europe’s banking sector releases the results of its stress tests on Friday. Spain is the main country to watch. Its domestic banks are thought to require a large amount of new capital that if they can’t raise on the markets will need to be funded by the government. This would only exacerbate the state of Spain’s public finances, so investors need to watch out for these results.

There is also a lack of clarity on whether or not Europe’s leaders will hold an emergency summit on Friday to come up with a plan to sort out private sector involvement in a fresh bailout for Greece. Germany has said there are no concrete plans and the final decision rests with EU President. This type of indecision is only adding to market uncertainty that the various branches of authority in the EU will fail to come up with a credible solution to the sovereign debt crisis.

The UK was also in the spotlight today. Labour market data for May was released. The unemployment rate stayed steady at 7.7 per cent; however, it may not stay this way for long. The jobless claims data for June was much stronger than expected, with 24.5k new claims, versus 15.0k expected.

Also, the Office for Budget Responsibility (OBR) released its first fiscal sustainability report and it makes for grim reading. Public sector pension liabilities are expected to top GBP 1 trillion, which is GBP332bn more than last year on the back of lower bond prices. This liability does not usually appear on the UK’s balance sheet, and highlights the extent of claims on public finances that are held out of sight in off-balance sheet vehicles.

When pensions are included this pushes the national debt up to 84.5% of GDP last year, compared with 52.8% by using traditional methods. This is worrying, especially as Europe’s finances come under ever closer scrutiny by the bond markets.

The OBR also said that rising longevity was adding to the UK’s debt burden, particularly healthcare spending. This would require either a permanent tax increase or a spending cut of 1.5% of GDP, the equivalent of GBP 22 billion, to bring the UK’s finances back to a sustainable path by 2017. So there could be much more fiscal consolidation to come.

Sterling is fairly stable after the report was released. Ahead today, listen out for the Fed’s Ben Bernanke who is giving testimony to the House of Representatives at 1500 BST/ 1000 ET, to hear just how close the US central bank is to implementing more stimuli to try and boost the economy.

Источник: Forex.com

13.07.2011

Динамика валютных курсов

Динамика валютных курсов