Invisibility Spurs Safe Haven Demand

Invisibility Spurs Safe Haven Demand

* The dollar rose against the euro but fell versus the yen in NY trading Tuesday on increased risk aversion after the administration’s financial-recovery plan did little to boost investor confidence in the financial sector. The euro extended overnight losses, falling on concerns over the eurozone’s exposure to Eastern Europe’s debt debacle. Unable to penetrate resistance, sterling was severely pressured by the gloomy outlook of the global banking system. The Canadian and Australian dollars declined on increased risk aversion as most commodities fell on the deteriorating global economic outlook. The Swiss franc, like the greenback and yen, was supported by safe haven demand.

* The USD/JPY fell after the administration’s financial-rescue plan painted a long and painful recovery path. The pair had attempted to penetrate the 92-area resistance on optimism of the recovery plan, which ended today in a classic buy-the-rumor-sell-the-fact pattern. The market was disappointed there was no silver bullet to cure the banks’ problems. Still, the USD/JPY did not break the recent trading range and US stocks remain above critical support. The USD/JPY has support in the 89-area and resistance in the 92. If US stocks break support of November lows, the USD/JPY will fall to new cycle lows.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US wholesale inventories fell a more-than-expected 1.4% m/m to a seasonally adjusted $427.50 billion in December, the fourth consecutive monthly fall and the longest such stretch in almost seven years, after a downwardly revised 0.9% m/m decline in November, data from the Commerce Department showed. Wholesalers had goods to last 1.27 months at the current sales pace, the highest level since 2002. Wholesale sales fell 3.6% m/m in December to a seasonally adjusted $336.07 billion, following November’s downwardly revised 7.3% m/m fall. December wholesale sales dropped 10.7% y/y, while wholesale inventories rose 3.4% y/y.

www.cmsfx.com

* Treasury Secretary Timothy F. Geithner announced a “comprehensive” strategy on the financial crisis and called for more direct capital injections, a new program to address banks’ toxic assets and more focus on consumer credit. While pledging government financing for as much as $2 trillion, he stressed the key components of the administration’s financial-recovery package are a joint public- and private-sector fund to purchase as much as $1 trillion of illiquid assets and a $1 trillion program to supply new credit to consumers and businesses. The administration also will inject additional taxpayer funds into banks and impose tighter restrictions. Geithner did not go into details about the package but warned that the strategy will “cost money, involve risk and take time.”

Europe

* Switzerland’s CPI fell a more-than-expected 0.8% m/m in January after falling 0.5% m/m in December, according to the Federal Statistical Office. The consumer-price inflation rate slowed more than expected to 0.1% y/y from November’s 0.7% y/y.

* The UK total trade deficit fell more than expected to £3.6 billion in December from November’s £4.0 billion, data from the Office for National Statistics showed. The goods trade deficit fell to £7.4 billion in December, with exports increasing 0.5% to £19.7 billion while imports declining 2.5% to £27.1 billion. The trade deficit with EU countries increased to £3.2 billion in December from £2.9 billion in November, while the trade deficit with non- EU countries declined more than expected to £4.2 billion from November’s revised £5.2 billion.

www.cmsfx.com

* UK retail sales values in January increased 1.1% y/y on a like-for-like basis, and 3.2% y/y on a total basis, both the best performance since May, the British Retail Consortium reported.

* UK house prices dropped at a faster rate in January than in December and the outlook for prices turned gloomier, according to a survey by the Royal Institution of Chartered Surveyors. The RICS UK seasonally adjusted house price balance declined to -76.3 in January from -73.9 in December, indicating the housing market remains in a depressed condition.

Asia-Pacific

* Australian business confidence plunged to a record low in January on declining exports, with the NAB Australian business confidence index falling to -32, the lowest level since records started in 1989, from December’s -20, National Australia Bank reported. The business conditions index declined to -11 in January from -6 in December.

www.cmsfx.com

* China’s consumer prices cooled to the weakest pace since 2006, increasing 1.0% y/y in January, after a 1.2% y/y rise in December, the statistics bureau said. Producer prices fell 3.3% y/y in January, the deepest fall in almost seven years, following December’s 1.1% y/y decline.

* Japanese consumer confidence remained near record lows in January, with the consumer confidence indicator increasing slightly to 27.0 from December’s 26.7. Excluding one-person households, consumer confidence unexpectedly improved modestly to 26.4 from December’s 26.2 record low. However, the income growth component declined further to 31.4 in January from 31.5 in December, while employment deteriorated to 14.2 from December’s 15.4.

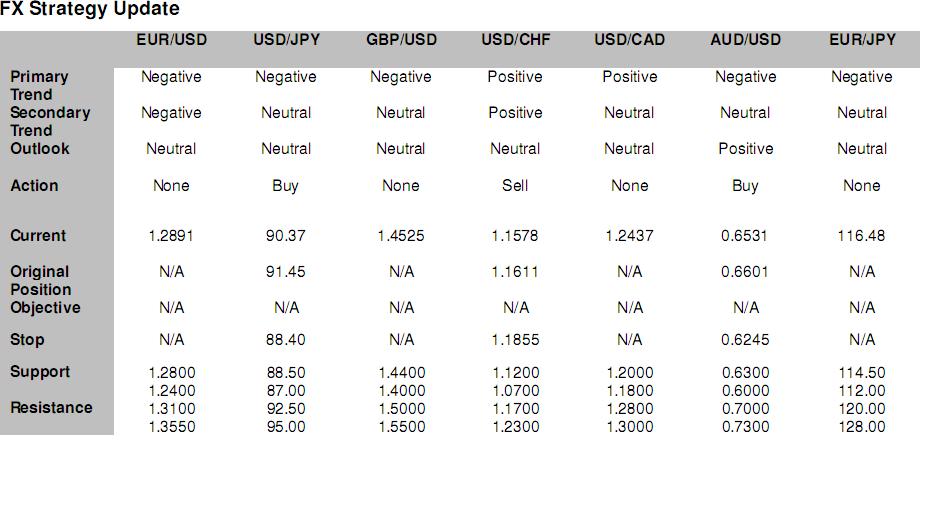

FX Strategy Update

Hans Nilsson and Winnie Tapasanun

New York, February 10, 2009, 17:20 EST

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

10.02.2009

Динамика валютных курсов

Динамика валютных курсов