Sterling Sinks on BOE Governor King’s Comments

Sterling Sinks on BOE Governor King’s Comments

* The dollar was flat against most major currencies on Wednesday. The yen was little changed while US stocks advanced on optimism the US economic-stimulus package looked likely to pass. The euro was modestly lower after European Central Bank Executive Board member Jose Manuel Gonzalez-Paramo said the current interest rate is not the lowest that policy makers can envisage. After yesterday’s strong risk aversion sell-off, the Canadian and Australian dollars rose modestly despite Canada’s declining exports and Australian falling consumer confidence.

* The GBP/USD extended its losses as the Bank of England signaled it was prepared to take unconventional steps to revive the UK economy. BOE Governor Mervyn King said the UK economy was in “deep recession” and the risks are to the downside, adding that the central bank would discuss buying assets directly to boost the money supply, at its next interest-rate decision meeting. The BOE is planning to add new policy tools as the key bank rate is approaching zero. The GBP/USD has been pressured by concerns about the solvency of the UK banking system. The pair rallied from the January 23 low of 1.3502 on a short covering and profittaking rally to the upper band of the downward sloping channel. Technically and fundamentally, the GBP/USD looks weak and may test the 1.35 again. We sell the pair with stop at 1.4865.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* The US trade deficit in goods and services narrowed to the smallest since 2003, shrinking 4.0% to $39.9 billion in December, smaller than November’s revised 41.6 billion but larger than the consensus expected $35.7 billion, data from the Commerce Department showed. Both exports and imports dropped for the fifth consecutive month in December. Exports fell 6.0% to $133.8 billion in December, with sales abroad of USmade automobiles, parts and engines dropping to the lowest level since November 2004. Imports declined 5.5% to $173.7 billion, the lowest since September 2005, from November’s $183.9 billion. The deepening US recession is dramatically narrowing the trade gap. The trade deficit with China shrank to $19.9 billion, while the trade gap with Canada narrowed to $2.8 billion. The trade gap with the European Union, however, widened to $7 billion as imports from the EU increased. Adjusted for inflation, the trade deficit in goods was $43.3 billion in December, $6.9 billion smaller than last year. Without adjusting for inflation, the trade deficit for goods and services was $17.7 billion smaller than last year.

www.cmsfx.com

* Canada’s trade deficit was C$458 million ($366 million) in December, marking the first trade gap since March 1976, following November’s downwardly revised C$1.16 billion trade surplus, Statistics Canada reported. Exports fell 9.7% to C$35.3 billion, the largest decline since 1982. Imports declined 5.7% to C$35.8 billion.

www.cmsfx.com

* Canadian new housing prices declined 0.1% m/m in December, the third consecutive monthly decline, after a 0.3% m/m decrease, Statistics Canada said. New housing price increased 0.4% y/y in December, a slower pace than November’s 0.7% y/y increase.

Europe

* German consumer prices declined 0.5% m/m in January, the Federal Statistical Office confirmed, after 0.3% m/m increase in December. Consumer-price inflation slowed to 0.9% y/y from December’s 1.1% y/y. In EU harmonized terms, the CPI declined 0.6% m/m in January, in line with preliminary estimates, after a 0.4% m/m increase in December. The HICP growth rate decelerated to 0.9% y/y from December’s 1.1% y/y.

* The UK labor market deteriorated further as UK jobless claims rose 73,800 to 1.23 million in January, the highest level since July 1999 and the 12th consecutive rise, following December’s upwardly revised 79,900 rise, data from the Office for National Statistics showed. The claimant count rate increased to 3.8% in January, the most since February 2000, from 3.6% in December. The unemployment total based on International Labor Organization methods rose 146,000 in the quarter through December to 1.97 million, the highest since August 1997. The unemployment rate was 6.3% for the three months to December, the most since March 1998, up 0.4 over the previous quarter and up 1.1 over the year. Average earnings including bonuses increased 3.2% y/y in the three months through December, unchanged from the period through November. Excluding bonuses, wage growth was unchanged at 3.6% y/y.

www.cmsfx.com

* According to the Bank of England’s latest inflation report, the BOE said: “CPI inflation falls well below the 2% target in the medium term, as the drag from a substantial margin of spare capacity more than outweighs the waning impact on import and consumer prices from the lower level of sterling. The near-term path of inflation is uneven. That reflects two further factors: first, the marked fall in energy prices, which drags down sharply on inflation during 2009; and, second, the direct impact of the temporary cut in VAT, which pulls down inflation during 2009 but briefly pushes it back towards the target in early 2010. The balance of risks around the central projection for inflation is judged to be slightly on the downside.” Regarding the UK economic growth outlook, the BOE projected “the prospects for economic growth remain unusually uncertain, reflecting the exceptional economic and financial factors affecting the outlook,” warning that the risks to UK economic growth are “heavily to the downside.” BOE Governor Mervyn King, warning of the deepening UK recession, said the BOE could begin quantitative easing as soon as in March. “Further easing in monetary policy may well be required. That is likely to include actions aimed at increasing the supply of money in order to stimulate nominal spending,” King said.

* Sweden’s Riksbank, citing a sharp deterioration in economic activity and easing inflation, slashed its repo rate 100 basis points to 1.00%. The Riksbank expects an economic recovery to begin in 2010 as the financial system begins to normalize and uncertainty subsides. “The effects of the fiscal policy measures taken around the world will also contribute to the recovery,” the bank said, adding that “the weaker krona will also dampen the fall in growth and keep inflation in Sweden closer to the target of 2 per cent.”

Asia-Pacific

* Australian consumer confidence dropped in February on rising unemployment and dropping property prices, with the Westpac–Melbourne Institute consumer sentiment index declining 4.6% to 85.8, remaining below 100 since February 2008, following January’s 89.9, Westpac Banking Corp. and Melbourne Institute reported.

* Australian home-loan approvals rose a more-than-expected 6.4% to 52,974 in December, the largest increase since May 2000, the Australian Bureau of Statistics reported. The total value of lending rose 5.9% to A$18.633 billion in December. The value of lending for owner occupied housing rose 7.1% to A$13.506 billion, while the value of lending for investment housing increased 2.9% to A$5.127 billion.

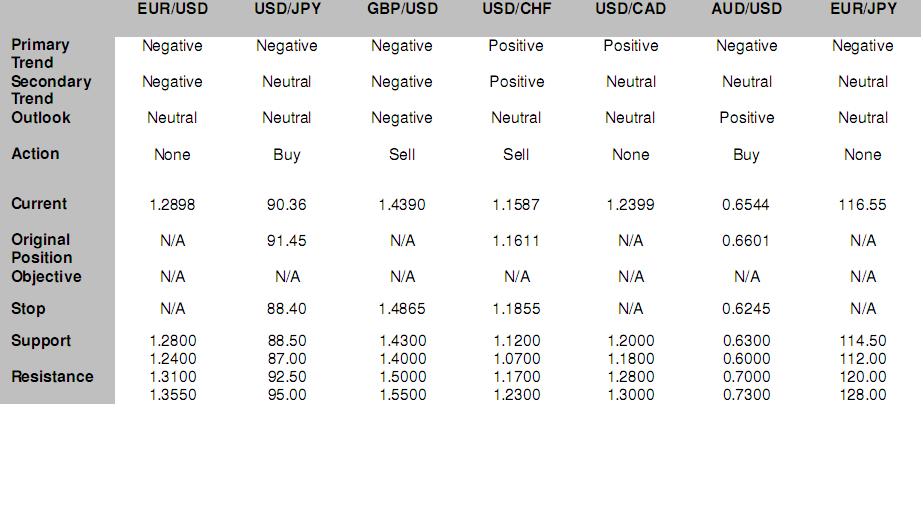

FX Strategy Update

Hans Nilsson and Winnie Tapasanun

New York, February 11, 2009, 17:20 EST

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

11.02.2009

Динамика валютных курсов

Динамика валютных курсов