Dollar Falls as Stocks Find Bottom

* The dollar fell versus other key currencies as stocks rallied across the board after Citigroup said it was having its best quarter since 2007. The S&P 500 rose 6.4%. Increased risk appetite reduced safe haven appeals for the dollar and yen. While rising against the dollar, the yen was mostly lower against other key currencies, pressured by weaker-than-expected business conditions in Japan. Sterling traded near its 6-week low against the dollar and fell against the euro as UK housing sales dropped to the lowest level since at least 1978 and manufacturing contracted the most in four decades. Both the euro and sterling lost most of their earlier gains against the greenback; thus, signaling better US economic prospects (as indicated by the Globicus US leading economic index reported yesterday), not only safe haven flows, may start benefiting the dollar. The Australian dollar rose on increased risk appetite and higher commodity prices.

* The USD/CAD fell from a 4-year high as equities worldwide rose and higher crude oil prices signaled investors are stepping up purchases of riskier assets. The pair failed to penetrate the important 1.3000 resistance; consequently, triggering widespread profit-taking. The pair is still in an uptrend. We expect a test of the 1.26-area support. If this is broken, the USD/CAD will test the 1.20-support. Resistance is in the 1.30-area.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US wholesale inventories declined a less-than-expected 0.7% m/m in January to a seasonally adjusted $424.23 billion, after a downwardly revised 1.5% m/m fall in December, according to the Commerce Department. Wholesale sales fell 2.9% m/m to a seasonally adjusted $326.15 billion, following December’s downwardly revised 3.7% m/m drop. While inventories declined in January, the inventory-to-sales ratio (the amount of goods on hand relative to sales) rose to 1.30 in January, the highest since January 2002, from 1.27 in December. Sales dropped much faster than inventories in January, indicating businesses will cut orders further in coming months. Sales fell 15.4% y/y in January, while inventories increased 1.0% y/y.

www.cmsfx.com

* Federal Reserve Chairman Ben S. Bernanke urged a sweeping overhaul of US financial regulations to stem risk build-ups in financial markets. “We should review regulatory policies and accounting rules to ensure that they do not induce excessive” swings in the financial system and economy, Bernanke said at the Council on Foreign Relations.

Europe

* Germany’s imports declined a less-than-expected 0.8% m/m to ?58.1 billion in January after a downwardly revised 4.8% m/m fall in December, while exports fell a more-than-expected 4.4% m/m to ?66.6 billion following December’s downwardly revised 4.0% m/m decline, data from the Federal Statistical Office showed. The trade surplus in January rose less than expected to ?8.5 billion from December’s upwardly revised ?7.3 billion. The current account surplus was below expectations at ?4.2 billion, down from December’s upwardly revised ?12.7 billion.

* Germany’s consumer-price inflation accelerated for the first time in seven months in February, according to final February CPI data by the Federal Statistical Office. The CPI increased 0.6% m/m in February after falling 0.5% m/m in January. The consumer-price inflation rate rose to 1.0% y/y from January’s 0.9% y/y. In EU harmonized terms, the HICP increased 0.7% m/m in February after falling 0.6% m/m in January, and the consumer-price inflation rate rose to 1.0% y/y from January’s 0.9% y/y.

* UK industrial production fell a more-than-expected 2.6% m/m in January, the sharpest fall since June 2002, after an upwardly revised 1.5% m/m decline in December, according to the Office for National Statistics (ONS). Industrial production fell a more-than-expected 11.4% y/y, its sharpest drop in 18 years, following December’s upwardly revised 9.3% y/y decline.

* UK manufacturing production decreased a more-than-expected 2.9% m/m in January and 6.4% in the three months through January, the most since records began in 1968, data from the ONS showed. Manufacturing production fell a more-than-expected 12.8% y/y, its deepest decline since January 1981, following December’s upwardly revised 9.9% y/y decline.

* UK housing sales fell to the lowest since at least 1978 as a deepening UK recession pushed prices down further, the Royal Institution of Chartered Surveyors said.

Asia-Pacific

* Australian business confidence remained near a 2-decade low, with the NAB business sentiment index increasing to -22 in February from -32 in January, the 14th consecutive month pessimists have outnumbered optimists, National Australia Bank Ltd. reported. Job advertisements dropped a record 10.4% m/m and 39.8% y/y in February, according to Australia and New Zealand Banking Group Ltd.

* China’s consumer prices fell 1.6% y/y in February, its first decline since 2002, after reaching an 11-year high last year, the Statistics Bureau said. Producer prices dropped 4.5% y/y, the most in a decade.

* Japan’s current and future business conditions deteriorated further in January. The leading index fell slightly more than expected to 77.1 in January, preliminary data from the Cabinet Office showed, following December’s downwardly revised 79.4. The coincident index, measuring current economic activity, declined to 89.6 from December’s downwardly revised 92.2.

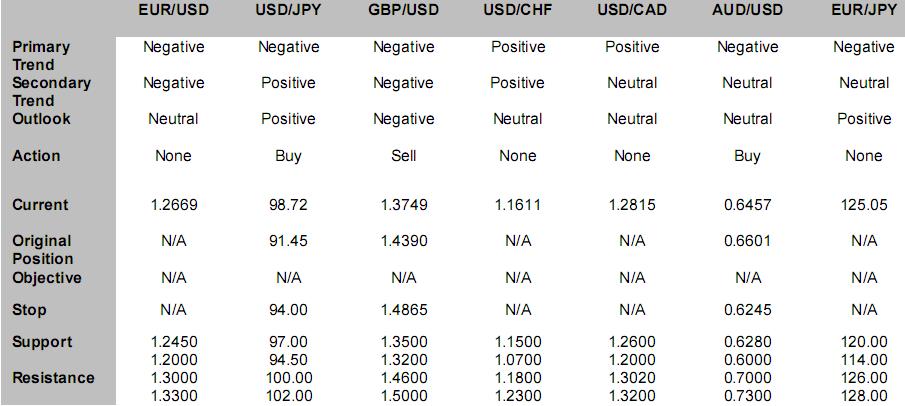

FX Strategy Update

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

Источник: Hans Nilsson

10.03.2009

Динамика валютных курсов

Динамика валютных курсов