USD/JPY at Resistance Ahead of G-7 Meeting

USD/JPY at Resistance Ahead of G-7 Meeting

* The dollar and yen fell against other major currencies on Friday as talk of a US government plan to subsidize mortgage payments boosted risk appetite ahead of this weekend’s G-7 meeting in Rome. The most important result of this meeting would be to contain rising protectionist sentiment. The ongoing battle between risk taking and fear continued. The dollar and yen have been supported by safe haven flows as investors deleverage and repatriate funds, while most other key currencies benefit when equity and commodity prices rise. The euro gained despite reports showing the eurozone Q4 2008 GDP contracted at its fastest pace on record and the German Q4 2008 GDP shrank at its sharpest rate in more than two decades. Sterling rose but pared gains as Lloyds Banking Group warned that its HBOS subsidiary would report an unexpected large pre-tax loss of £10 billion. The Australian dollar rose after the Australian Senate passed the government’s stimulus bill and the Canadian dollar advanced despite falling commodity prices. Despite today’s losses, the greenback gained against its rivals for the week.

* The USD/JPY rose for a second day despite the decline in US stocks as the banking sector was weak. The pair rose to the 92-area resistance ahead of the G-7 meeting where finance ministers and central bankers from the major industrial nations will pledge to restore confidence in the global financial system. Japan’s Finance Minister Shoichi Nakagawa said he is not planning to bring up the strong yen at the G-7 meeting. However, Japan may receive some verbal support as the G-7 is likely to repeat its mantra “excess volatility and disorderly movements” in exchange rates should be avoided. The USD/JPY has been in sideways trading pattern this year, with recent support in the 89-area and resistance in the 92. A break of the resistance should lead to a strong rally if accompanied by higher stock prices.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US consumer confidence fell more than expected in February amid dramatic job losses and dropping house prices in an intense recession. The Reuters/University of Michigan preliminary sentiment index declined for the first time in three months, to 56.2, from January’s 61.2. The consumer expectations index dropped to 49.1 in February, the lowest since 1980, from 57.8 in January. The current conditions index slightly improved to 67.1 from 66.5. The February report noted a decline in US inflation expectations, with consumers seeing a 1.6% inflation rate over the next 12 months and a 3.0% rate over the next five years. In the January report, inflation expectations were 2.2% and 2.9%, respectively.

www.cmsfx.com

* The US House of Representatives passed President Barack Obama’s $787 billion economic stimulus package designed to revive the economy through tax cuts for businesses and families and a half-trillion dollars in federal spending. The vote was 246 to 183, reflecting the Democrats’ considerable majority and the Republicans’ deep dissatisfaction with the plan.

* The Obama administration’s housing recovery plan will accelerate loan modifications for distressed homeowners and reform the bankruptcy system for foreclosures, Housing Secretary Shaun Donovan said.

* President Obama will outline his plan to stem foreclosures next week, the White House said.

Europe

* The Globicus eurozone leading economic index declined at a 7.7% rate in December, indicating the eurozone economy will contract further in Q1 and Q2 2009. The coincident index, measuring the current state of the economy, fell at an 8.5% rate in December, indicating the economy contracted at over 8.0% annualized rate at the end of 2008. In non-annualized terms, the EMU GDP contracted 1.5% q/q in Q4 2008, according to advance data from Eurostat, the same pace of contraction as in the UK but faster than the 1.0% q/q reported in the US.

www.cmsfx.com

* The eurozone GDP shrank at a record pace in Q4 2008, contracting a more-than-forecast 1.5% q/q, the most since eurozone GDP records began in 1995, advance estimates from Eurostat showed, following Q3’s 0.2% q/q decline. The GDP contracted a more-than-expected 1.2% y/y in Q4, the only full-year drop on record, after a 0.6% y/y increase in Q3. The eurozone economy expanded 0.7% in 2008, down from 2.7% in 2007.

www.cmsfx.com

* Germany’s GDP shrank for the third straight quarter, contracting a more-than-expected 2.1% q/q in Q4 2008, its sharpest pace in more than 20 years, preliminary estimates from the Federal Statistical Office showed, following a 0.5% q/q decline in Q3. In weighted daily average terms, the economy contracted a more-thanexpected 1.7% y/y in Q4, after a 0.8% y/y increase in Q3. In non-seasonally adjusted terms, the GDP shrank a more-than-expected 1.6% y/y, following Q3's upwardly revised 1.4% y/y gain.

www.cmsfx.com

* Switzerland’s producer and import prices fell for a sixth month in January, falling 0.8% m/m, after December’s 0.7% m/m decline, the Federal Statistical Office said. Producer and import prices fell 0.9% y/y in January, following a 0.4% y/y increase in December.

* In short, eurozone fundamentals show the eurozone economy is in its deepest recession on record with inflation decelerating. Leading indicators suggest the recession will be prolonged. Thus, the European Central Bank will possibly cut its main refinancing rate to record lows of 1.00% in 2009.

Asia-Pacific

* The Australian Senate approved Prime Minister Kevin Rudd’s A$42 billion ($28 billion) economic stimulus package. The legislation comprises A$12.7 billion in payments to low- and middle-income earners and A$28.8 billion in infrastructure projects. The package is equivalent to 1.3% of GDP in 2009 and 2.0% of growth in 2010.

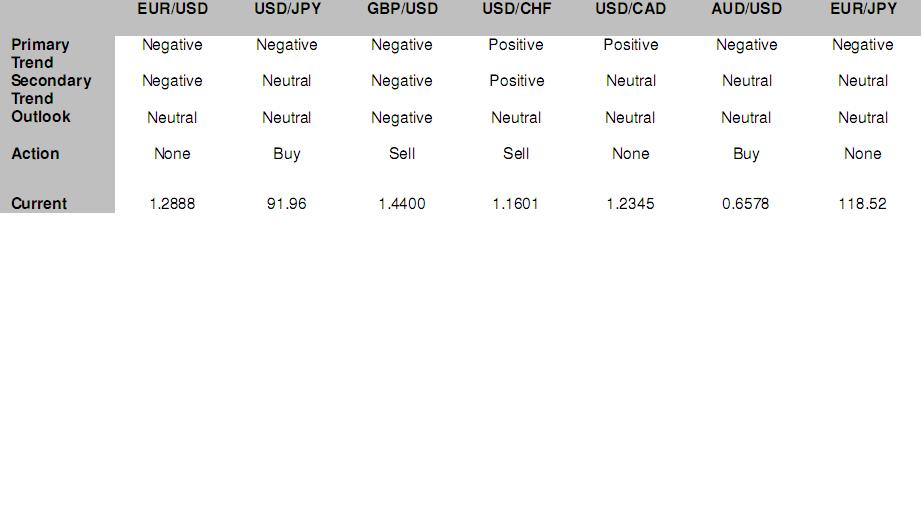

FX Strategy Update

Hans Nilsson and Winnie Tapasanun

New York, February 13, 2009, 16:00 EST

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

13.02.2009

Динамика валютных курсов

Динамика валютных курсов