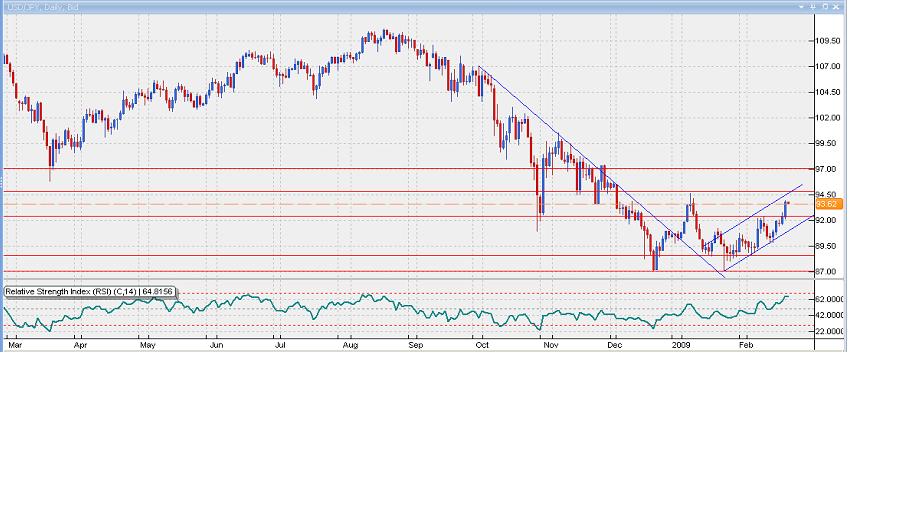

USD/JPY Breaks Resistance

* The dollar traded mostly higher against its rivals on Wednesday as US housing starts fell to a record low and President Barack Obama released a $75 billion housing program to stem home foreclosures. US stocks were little changed, testing support from the bear-market lows of November 2008. The FOMC minutes showed the Fed reduced its US economic growth outlook for 2009 and 2010. The euro continued to be under pressure as eurozone banks have by far the largest exposure to Eastern Europe and other emerging economies. Sterling fell after Bank of England minutes showed the monetary policy committee is seeking an approval to move to quantitative easing policy, which will involve the purchase of securities. The Australian and Canadian dollars rose modestly.

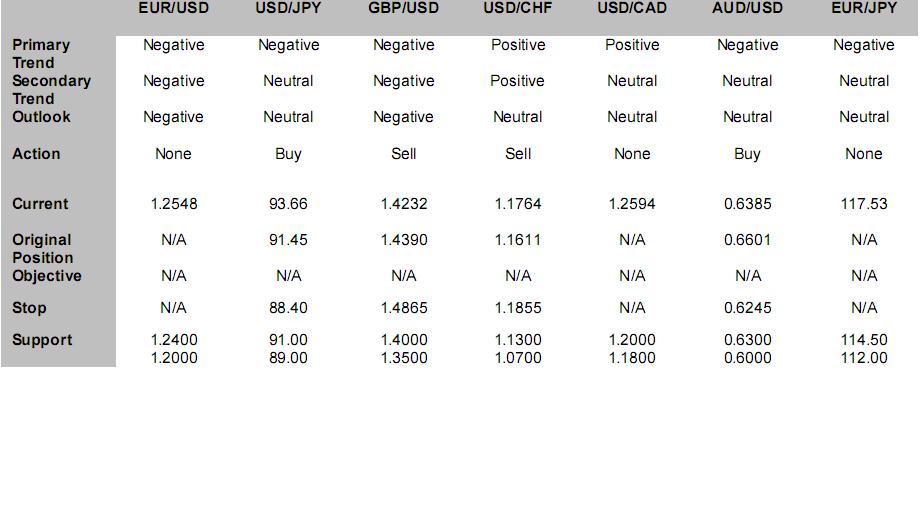

* The USD/JPY broke the 92-area resistance and rose to the highest level since January 7 as US stocks struggled to find a bottom. The yen also lost ground against most other key currencies as the yen’s safe haven appeals seem to fade. Economic and political risks have increased. Japan’s Finance Minister Shoichi Nakagawa quit after his well published trip and Japanese Prime Minister Taro Aso is unlikely to last long. The Bank of Japan is likely ease monetary policy to stimulate the free falling Japanese economy and help the suffering exports. The USD/JPY broke its 2008 downtrend, made a double bottom at the 87 handle and developed a tentative uptrend. This should be bullish for the USD/JPY. There are resistance in the 94-area and support from the recent uptrend at the 91-area. We expect the uptrend to continue and the 94-area support to be broken.

www.cmsfx.com

Financial and Economic News and Comments

US & Canada

* US housing starts dropped a more-than-expected 16.8% m/m in January to a seasonally adjusted 466,000 annual rate, the fewest since records began in 1959, following an upwardly revised 560,000 rate in December, data from the Commerce Department showed. Housing starts plunged 56.2% y/y. Starts for single-family homes fell 12.2% m/m, and those for multi-family units fell 27.9% m/m. Housing starts dropped across every major region of the country.

* US building permits declined a more-than-expected 4.8% m/m in January to a 521,000 annual rate, after a 547,000 pace in December, according to the Commerce Department. Single-family permits fell 8.0% m/m in January and plunged 50.4% y/y.

* Record low housing starts and building permits will keep the economy very weak. However, we don't really want housing starts to rise with housing inventories still close to record levels relative to sales. Lower inventories are a critical component to stabilize home prices, which eventually will be a critical component to a US economic recovery.

www.cmsfx.com

* US industrial production declined a more-than-expected 1.8% m/m in January to 101.3, the lowest level in more than five years, following a downwardly revised 2.4% m/m fall in December, according to the Federal Reserve. The IP fell 10.0% y/y. Manufacturing production declined 2.6% m/m in January, with about half the drop due to weak auto production and the other half due to widespread losses outside the auto sector. Manufacturing production fell 12.9% y/y. The production of high-tech equipment fell 3.2% m/m in January and dropped 12.8% y/y. Overall capacity utilization fell to 72.0% in January from a downwardly revised 73.3% in December. Manufacturing capacity utilization declined to 68.0% from December’s 69.7%.

www.cmsfx.com

* US import prices declined 1.1% m/m, as forecast, in January, the sixth consecutive decline, after a downwardly revised 5.0% m/m fall in December, data from the Labor Department showed. Import prices dropped 12.5% y/y, following December’s downwardly revised 10.3% y/y fall.

* Federal Reserve officials set 2.0% as a long-term US inflation goal and lowered their forecasts for economic growth this year with most seeing a 0.5%-1.3% contraction, according minutes of the Federal Open Market Committee meeting January 27-28 released today. Existing plans to buy debt issued or backed by government-chartered housing-finance companies, and to support securities backed by consumer loans, were “likely to be a more effective way” to use the Fed’s balance sheet, according to the minutes.

* “Increased clarity about the FOMC’s views regarding longer-term inflation should help to better stabilize the public’s inflation expectations, thus contributing to keeping actual inflation from rising too high or falling too low,” Fed Chairman Ben S. Bernanke said at the National Press Club in Washington.

* Canadian wholesale sales fell a more-than-expected 3.4% m/m in December to C$42.8 billion ($34.1 billion), the most since August 2003, following an upwardly revised 1.5% m/m decline in November, data from Statistics Canada showed.

Europe

* Eurozone construction output fell 2.2% m/m in December after a downwardly revised 1.7% m/m decline in November, Eurostat reported. Construction output dropped 10.1% y/y, the largest decline since 1991, following November’s downwardly revised 5.1% y/y fall. In 2008, construction output contracted 2.7%, the most since 1995.

<

* According to the Confederation of British Industry industrial trends survey for February, a balance of 56% of UK manufacturers said order levels were below normal, up from the 48% seen in January. February’s balance represents the weakest demand for UK manufactured goods since January 1992 with manufacturers expecting output levels to drop over the next three months, the CBI said.

www.cmsfx.com

Asia-Pacific

* The annualized growth rate of the Westpac–Melbourne Institute Australian leading index was -1.2% in December, remaining in negative territory for the second consecutive month and well below its long-term trend of 3.5%, the Westpac–Melbourne Institute reported. The annualized growth rate of the coincident index was 3.3%, up from November’s 2.4% but below its long-term trend of 3.7%. The December figures indicate a looming Australian recession, increasing the possibility of another Reserve Bank of Australian interest-rate cut on March 3.

* Australian retail sales rose a seasonally adjusted 0.8% q/q in Q4 2008 led by food retailing, following a 0.1% q/q increase in Q3, the Australian Bureau of Statistics reported.

* Japan’s leading index was at 80.0 in December, according to final data from the Economic and Social Research Institute, revised up from the initial estimate of 79.8 but down from November’s 81.8. The coincident index for December was upwardly revised to 92.4 from the initial estimate of 92.3 but below November’s 94.9. The lagging index declined to 94.4 in December from 97.1 in November.

FX Strategy Update

Hans Nilsson 2009-02-18

www.cmsfx.com

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

18.02.2009

Динамика валютных курсов

Динамика валютных курсов