Greenback and Stocks at Critical Levels

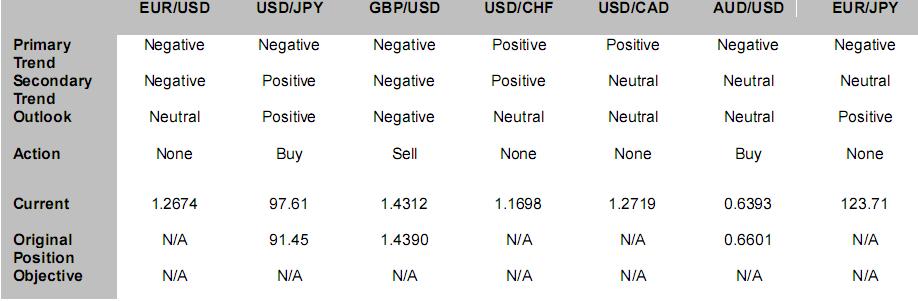

* The dollar gained against most major currencies on Friday on safe haven flows as US stocks closed near cycle lows. Risks and equity markets continued to be the dominant theme in the forex market. The yen gained from an oversold position, following steep losses earlier in the week. Japan's industrial production plunged in January as the global recession deepened. Revised US Q4 2008 GDP data showed the economy contracted at the steepest rate since 1982. The euro declined modestly, finishing a volatile week lower, as investors worried about the solvency of the European banking sector. Sterling was little changed as UK consumer confidence held near the weakest in 30 years.

* The USD/CAD rose on increased risk aversion and Canada's first current account deficit since Q2 1999. The pair closed at 1.2719, near its highest level this year. We believe the USD/CAD will move higher and test the important 1.30 resistance. If this is broken, the pair will rally.

USD/CAD

USD/CADFinancial and Economic News and Comments

US & Canada

* The US recession deepened more extensively in Q4 2008 than first reported. The Q4 US GDP contracted more than expected at a seasonally adjusted 6.2% q/q annual rate, the worst quarterly decline since Q1 1982, revised data from the Commerce Department showed, down substantially from a prior estimate of 3.8% q/q contraction. The Q4 GDP declined 0.8% y/y. Almost all major categories of GDP were revised downward, with the largest adjustments to inventory, trade, and personal consumption. Inventory added only 0.2 points to Q4 GDP growth versus an original estimate of 1.3. Trade subtracted 0.5 points from GDP versus a prior estimate that it added 0.1 points. Personal consumption subtracted 3.0 points versus a prior estimate of -2.5. The exception to the downward adjustments was home building, which subtracted 0.8 points from GDP rather than a prior estimate of -0.9. The largest drags on Q4 GDP were personal consumption and business investment in equipment and software, while the largest positive contributor was government spending. The Q4 GDP price index was upwardly revised to a 0.5% annual rate of increase from a prior estimate of a 0.1% rate of decline.

GDP

* The Chicago PMI in February unexpectedly increased to 34.2 from January's 27-year low of 33.3, still contracting for the 5th month in a narrow range of falling business activity in the Midwest, Kingsbury International, Ltd. and the Institute for Supply Management - Chicago, Inc. reported. Production and order backlog indexes continued to decline in February, at a slower pace; production increased to 34.7 from 29.7, and order backlogs increased to 29.3 from 26.5. The new orders index declined to 30.6 from 30.7. Unemployment accelerated in February, with the employment index dropping to 25.2 from 34.8. The price paid index continued to fall, but at a somewhat faster rate, falling to 37.8 from 39.8.

* US consumer confidence declined the first time in three months in February as consumers viewed the economy would remain in recession throughout 2009. The Reuters/University of Michigan final index of consumer sentiment fell to 56.3 in February from 61.2 in January, Reuters/University of Michigan reported. The consumer expectations index decreased to 50.5 from 57.8. The current conditions index declined to 65.5 from 66.5. Consumers in the February survey projected a 1.9% inflation rate over the next 12 months, compared with 2.2% in the January survey.

* Canada recorded a larger-than-expected current account deficit of C$7.49 billion ($5.94 billion) in Q4 2008, the first deficit since Q2 1999, after a revised C$3.63 billion surplus in Q3, data from Statistics Canada showed.

* Canada's industrial product prices fell for a third month in January, falling a less-than-expected 0.1% m/m, after December's downwardly revised 2.1% m/m decline, according to Statistics Canada. Raw materials prices unexpectedly increased 1.4% m/m, following December's 15.4% m/m drop.

Europe

* The eurozone unemployment rate rose more than expected to 8.2% in January, the highest in more than two years, following December's upwardly revised 8.1%, according to Eurostat.

* The eurozone consumer-price inflation rate slowed to 1.1% y/y, as forecast, in January, the lowest since July 1999, led by declining energy prices, following 1.6% y/y in December, Eurostat data showed.

* Increasing unemployment and decelerating inflation in the euro-area support a case for further European Central Bank interest-rate cuts to counter a deepening eurozone recession.

* Sweden has entered a recession. The Swedish GDP contracted the most in at least 14 years, shrinking an annual 4.9% in Q4 2008, adjusted for the number of working days, on falling global demand for Swedish exports, following a revised 0.1% decline in Q3, Statistics Sweden said. The Q4 GDP shrank a seasonally adjusted 2.4% q/q, the fourth straight quarterly decline. The contraction increases the possibility the Riksbank will cut its key repo rate to near zero this year.

* Switzerland's KOF leading index dropped to -1.41 in February, the lowest level since records began in 1991, following January's downwardly revised -0.93, according to Konjunkturforschungsstelle Swiss Institute for Business Cycle Research.

Asia-Pacific

* Declining fuel prices reduced price pressures in Japan. The Japanese consumer-price inflation rate decelerated to 0.0% y/y in January, as forecast, from 0.4% y/y in December, according to data from the Statistics Bureau. The CPI excluding fresh food slowed to 0.0% y/y in January, against expectations for a 0.1% y/y decline, from 0.2% y/y in December. The CPI excluding fresh food and energy declined 0.2% y/y, in-line with expectations and against December's flat reading.

* The consumer-price inflation rate in Tokyo accelerated more than estimated at 0.5% y/y in February, in-line with January's 0.5% y/y, data from the Statistics Bureau showed. The CPI excluding fresh food rose a more-than-expected 0.6% y/y in February after increasing 0.5% y/y in January. The CPI excluding fresh foods and energy declined a less-than-expected 0.1% y/y, following January's 0.3% y/y decline.

* Japanese industrial production fell for the third consecutive month in January, dropping a record 10.0% m/m, as forecast, preliminary data from the Ministry of Economy, Trade and Industry showed, following a 9.8% m/m decline in December. The industrial production plunged a slightly more-than-expected 30.8% y/y, following December's 20.8% y/y drop.

GDP

* Japanese household spending fell a more-than-expected 5.9% y/y in January, the largest drop in more than two years, after a 4.6% y/y decline, according to the Statistics Bureau.

* Japanese housing starts dropped a more-than-expected 18.7% y/y to 70,688 units in January, the second consecutive month of decline, according to the Land Ministry. Construction orders fell 38.3% y/y to ¥578.9 billion ($5.94 billion), the third straight month of decline.

* Japan’s job-to-applicant ratio fell the most since 1992 in January, falling to 0.67 from December’s upwardly revised 0.73, the Labor Ministry said. The unemployment rate unexpectedly declined to 4.1% from December’s downwardly revised 4.3% as housewives got part-time jobs to supplement falling incomes.

* Australia’s bank lending increased a more-than-expected 0.6% m/m in January, rebounding from the first decline since 1992, according to data from the Australian Bureau of Statistics.

* Thailand’s current account surplus widened to $2.29 billion in January, the widest since at least 1991, from $91 million in December, the Bank of Thailand said.

FX Strategy Update

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

Source: Hans Nilsson

27.02.2009

Currency Charts

Currency Charts