Yields erode support for EURUSD

The single currency has started the weak on the back-foot due to a few factors:

• The uncertainty about who will take over the ECB after Trichet’s term expires, after the resignation of Axel Weber (ultra hawk) President of the Bundesbank.

• News that Greece and Italy have voted against imposing harsh debt to GDP ratios.

• European Union finance ministers meeting that may throw up even more disagreements within the currency bloc about a long-term resolution to the debt crisis.

This is weighing on investor confidence and also on expectations of near-term ECB rate hikes.

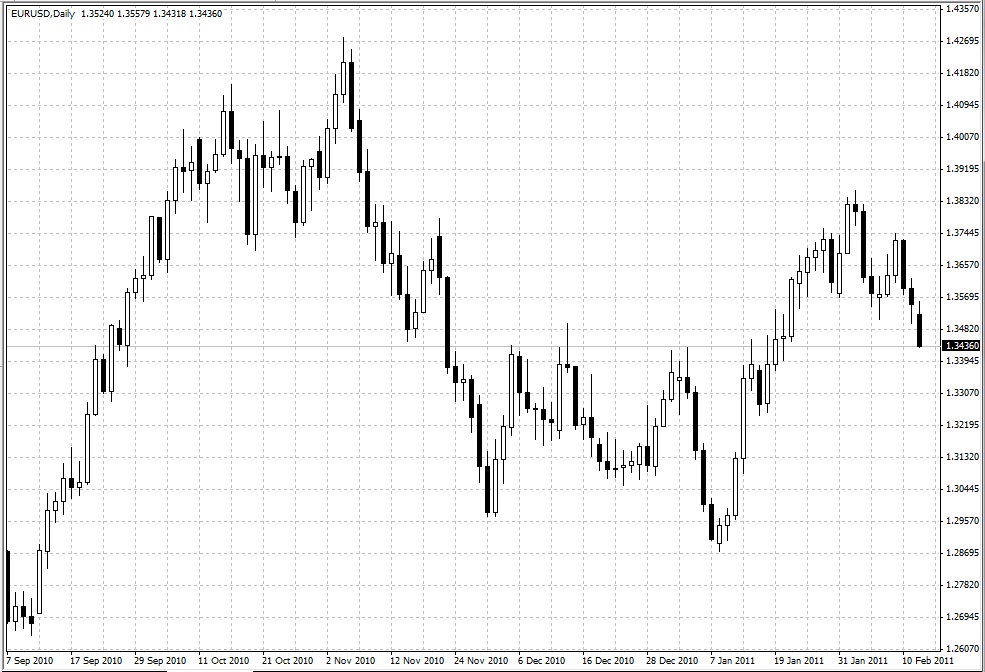

The spread between the Euro-area overnight interest rate and 3-month Euribor (the inter-bank lending rate) has continued to widen as near-term interest rate expectations for the euro area fall. This is weighing on EURUSD, as you can see in the chart below.

Without the benefit of yield support we think the euro will remain on the back foot.

It will take either a stronger tone to economic data, hawkish rhetoric from ECB members or a satisfactory solution to the sovereign debt crisis, and positive comments from this week’s eco fin min meeting that a resolution is forthcoming, for yields to recover and boost EUIRUSD.

Source: FOREX.com

14.02.2011

Currency Charts

Currency Charts