Waiting for Mr. Geithner

Waiting for Mr. Geithner

• In New York trading Monday, the dollar and yen traded lower on a modest increase in risk appetite as

Treasury Secretary Timothy Geithner delayed the announcement of the financial-rescue package. The new

plan is believed to target the most troubled banks and involve government guarantees and private funding as a

new component to address the toxic debt clogging banks’ balance sheets. The euro rose, approaching the

important 1.31-area resistance. The reception of the financial plan could determine whether the euro will

penetrate this important resistance. Sterling also approached its resistance at 1.50, helped by stronger-thanexpected

profits from UK’s Barclays Bank. The Canadian dollar gained as crude oil prices rose. The Australian

dollar advanced for a third day on improving risk sentiment.

• The CHF/JPY was little changed on Monday. The pair has declined about 25% since last summer. Still in a

clearly defined downtrend, the pair has made a double bottom. A penetration of the downtrend would have

long-term bullish implications for the pair. There are support in the 75-area and resistance from the downtrend

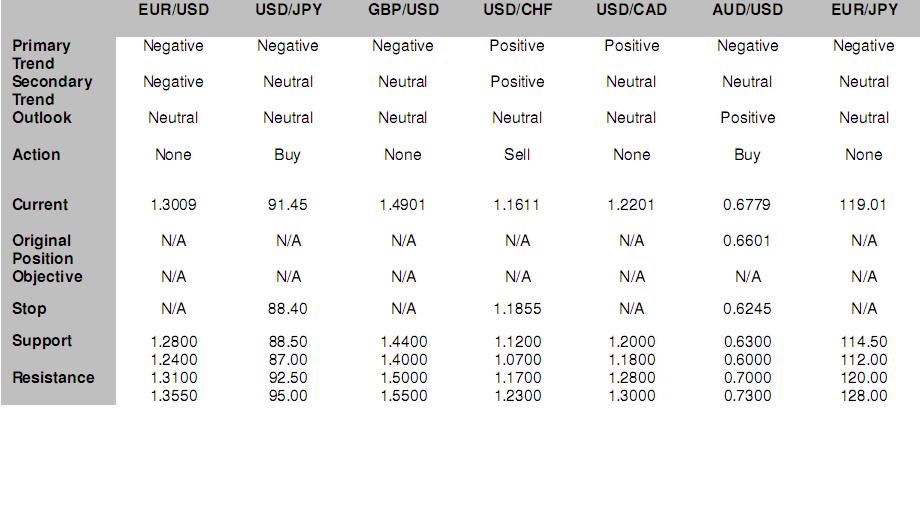

in the 80-area. We sell one USD/CHF and buy one USD/JPY.

Daily FX Strategy Briefing 2

February 9, 2009

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

Financial and Economic News and Comments

US & Canada

• Treasury Secretary Timothy Geithner will announce the Obama administration’s financial-stimulus package on

Tuesday.

• Canadian housing starts fell a more-than-expected 11% in January to 153,500 units on an annualized basis,

the fifth consecutive decline and the lowest since 2001, following 172,200 units in December, according to

data from Canada Mortgage and Housing Corp. Urban single-family dwellings dropped 20% to 50,000 units,

the lowest since February 1996. Multiple-unit projects such as condominiums fell 12% to 76,700.

• Canadian bankruptcies surged 47% y/y in December, according to the Office of the Superintendent of

Bankruptcy Canada.

Europe

• Germany’s trade surplus in December fell below expectations to ?6.9 billion from November’s upwardly

revised ?9.9 billion, the Federal Statistical Office said. The current account surplus rose more than expected to

?12.3 billion from November’s ?8.7 billion. Exports declined a seasonally adjusted 3.7% m/m in December to

?67.4 billion, following November’s 10.8% m/m record drop. Imports declined a seasonally adjusted 4.1% m/m

to ?60.4 billion, following November’s 5.8% m/m decrease.

• Eurozone investor confidence unexpectedly weakened in February with the Sentix investor sentiment index

falling to -36.1 from January’s -34.4.

Asia-Pacific

• Present conditions in the Japanese economy have improved in January and further gains are expected,

according to the Cabinet Office’s economy watchers survey. The current conditions index unexpectedly

increased to 17.1 in January from 15.9 in December. The outlook index rose to 22.1 from December’s 17.6.

Daily FX Strategy Briefing 3

February 9, 2009

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

• Japanese machine tool orders plunged 84.4% y/y in January after dropping 71.8% y/y in December, according

to preliminary estimates from the Japan Machine Tool Builders’ Association.

• Japanese machinery orders declined for a third month in December, falling 1.7 m/m, following November’s

16.2% m/m drop, the sharpest decline since records began in 1987, the Cabinet Office said. Machinery orders

in December plunged 26.8% y/y.

• Corporate bankruptcies in Japan rose 15.8% to 1,360 cases in January, the eighth monthly rise, Tokyo Shoko

Research Ltd. reported.

Daily FX Strategy Briefing 4

February 9, 2009

©2004-2008 Globicus International, Inc. and Capital Market Services, L.L.C.

FX Strategy Update

Tuesday’s Economic Calendar

Time

(EDT)

Region Data Period Change Forecast Previous

0:00 Japan Consumer confidence Jan 26.7

0:00 Japan

Consumer confidence

households

Jan 25.2 26.2

3:15 Switzerland CPI Jan -0.4% -0.5%

3:15 Switzerland CPI Jan 0.6% 0.7%

4:30 UK Visible trade balance Dec -£8100M -£8330M

4:30 UK Total trade balance Dec -£4250M -£4478M

4:30 UK Trade balance non-EU Dec -£4800M -£5304M

10:00 US Wholesale inventories Dec -0.7% -0.6%

10:00 US Treasury Secretary Timothy

Geithner testifies on TARP at

senate panel

10:00 US Federal Reserve Chairman Ben

Bernanke testifies on Fed

programs at house panel

18:30 Australia Westpac consumer confidence Feb -2.2%

19:30 Australia Home loans Dec 3.5% 1.3%

19:30 Australia Investment lending Dec 1.0% -6.1%

19:30 Australia Value of loans Dec m/m 2.3% 1.4%

Notes: N/A=not applicable/not available, ar=annual rate, sa=seasonally adjusted, nsa=non-seasonally adjusted, 3 mths=3 months,

m/m=month-on-month, q/q=quarter-on-quarter, y/y=year-on-year, ytd=year-to-date, m=million, b=billion, t=trillion, unch=unchanged,

a=advance, p=preliminary, r=revised, f=final, GDP=gross domestic product, CPI=consumer price index, PPI=producer price index,

PMI=purchasing managers index

Hans Nilsson and Winnie Tapasanun

New York, February 9, 2009, 14:40 EST

10.02.2009

Currency Charts

Currency Charts