Weekly Oil Market Outlook: The path of least resistance for crude oil still points north

Crude oil prices retreated Thursday as market participants were assuaged by assurances from the IEA and Saudi Arabia of sufficient capacity to offset any supply deficiencies from Libyan unrest – WTI slid -1.57% to $96.55/bl and Brent declined -.63% to $110.55. The ‘flight to safety’ trade stayed the course, however, evidenced by persisting downside in U.S. equities and UST yields. Safe haven inflows were confirmed in currency markets as well. Swissy demand sent USD/CHF to record lows around 0.9230 suggesting caution for oil shorts as Thursday’s price action appears to be more a result of markets taking a breather, profit taking, and/or end of month flows rather than the onset of a sustained risk reversal.

A number of factors suggest oil prices may continue to trend higher. The latest U.S. weekly inventories report printed on the bullish side – crude oil stockpiles increased +0.8mbs vs. expected +1.1mbs while distillates and gasoline stockpiles declined more than expected by -1.3mbs and -2.8mbs, respectively. Demand readings trended higher despite higher prices – EIA US oil demand data (week ending Feb. 18) printed +2.3% against the prior week’s +1.5% reading.

Additional oil price support comes from the firming outlook for a weaker USD. Diverging interest rate expectations between the Fed and various other central banks, mainly the ECB and BoE, has seen the greenback lose much of its early February luster. Furthermore, concerns that triple digit oil prices may undermine the U.S. recovery have also weakened the greenback – the USD index is down almost -2% since last week – which in turn has played a part in oil price upside. January’s -12.6% drop in new home sales added more fuel to the ‘moderating U.S. economic recovery’ fire which evidences a U.S. housing market that has veered off the path to recovery.

The near to medium term outlook for prices, however, remains dependent on the primary source to crude oil’s parabolic ascent – Middle East & African production. Prices are likely to trend higher if real supply disruption out of Libya intensifies, Libyan oil output averages about 1.58 Mb/d. Oil prices would receive a more substantial boost if the Libyan crisis were to spillover to other oil producing countries -Algeria, Kuwait, and Iran being potential hotspots for this.

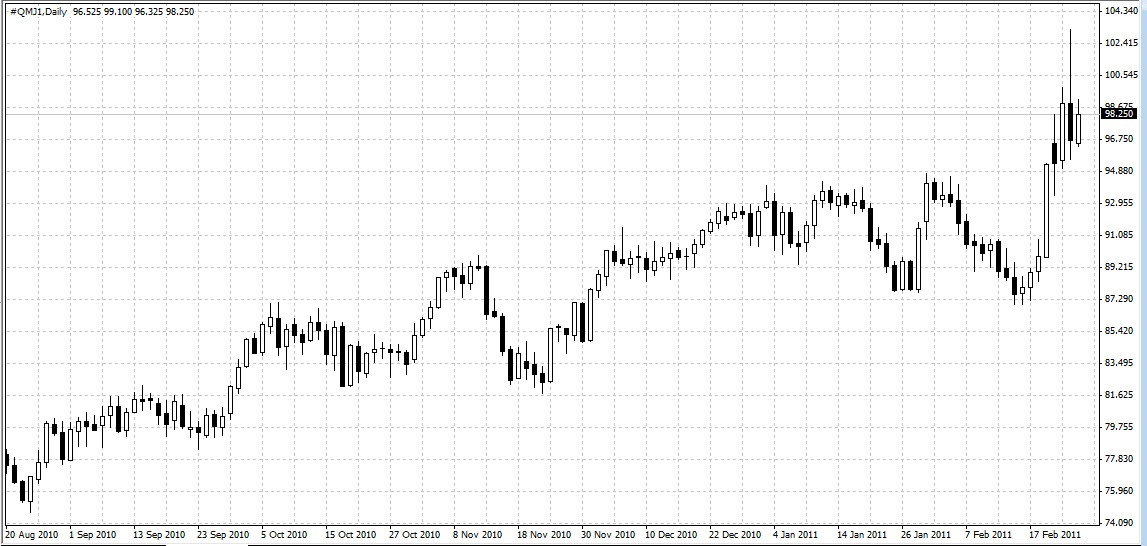

That said, the risk is for further oil price (WTI as our proxy) upside on the technical front as well (see chart below). While above channel support (84.00/bl), potential upside targets lie ahead into the psychologically key $100/bl level ahead of $103.40/bl (0.618 fibo level - 147.27/39.50 decline), $120.00/bl (0.764 fibo level - 147.27/39.50 decline), and finally the $147.27/bl record highs. For this to occur, however, production outputs would have to be severely disrupted from spreading turmoil in the Middle East and Africa. Judging from what we’ve seen with Egypt and now Libya in just a matter of weeks, the possibility for such disruptions cannot be dismissed.

Risks to our outlook for higher oil prices may arise from a correction to the recent bout of USD weakness and/or abating unrest in the MENA (Middle East & Africa) region. However, we think the bullish supply-demand profile, weakening USD on diverging rate outlooks, and still substantial risks for a spillover effect in MENA unrest are likely to remain oil price supportive in the week ahead.

Source: FOREX.com

25.02.2011

Currency Charts

Currency Charts