Risk Off, Risk On

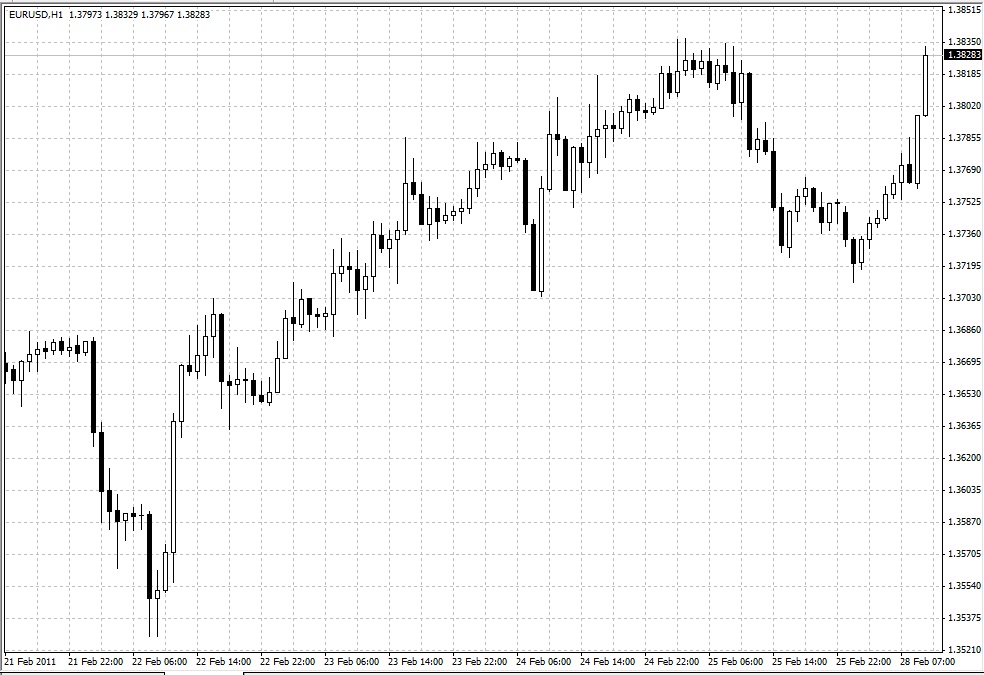

The US Dollar opened the new week with a little bit of muscle, however, as the day wore on all gains by the Greenback eroded back to unchanged for the day. Continued unrest in the nation of Libya and new rioting flare ups in the nation of Oman saw early bids in the dollar and yen. Adding to the risk adverse atmosphere early on was talk from the new government of Ireland that they wish to less some of the unpopular austerity measures imposed on their people and would like to renegotiate the terms of their EU/IMF bailout loans. This bit of news did not bode well for the EUR/USD, which slide from opening levels near 1.3760 to lows of 1.3710 on the day.

The yen crosses followed the move as traders looked for the perceived safety of the Japanese yen.

The trip lower did not last too long however, as the markets turned around and most risk pairs were able to overtake their earlier opening levels. The formula stood true for the GBP/USD and the AUD/USD as well, the Aussie taking a hit from early reports of China lowering its annual economic expansion target to 7%. AUD/USD dropped to 1.01200 but bounced back to see highs just North of 1.01800. While the yen crosses rebounded, USD/JPY remained tight near 81.65.

With violence still the norm in North Africa, the Swiss Franc remained the safe haven of choice in Asia, as USD/CHF remained soft under 0.9265, certainly within striking distance of recent lows for the pair near 0.9232. Oil remained elevated with the continued fear of contagion in the fragile Arab world with light, sweet crude oil close to $100 per barrel and BCO/USD, Brent crude oil, seeing just over $114 per barrel. West Texas Intermediate crude or WTI/USD continued to hover near the $100 mark.

Be prepared for a big data week ahead with rate decisions and statements from the RBA, ECB and BOC as well as commentary from FOMC Chairman Ben Bernanke and US NFP employment data wrapping the week up on Friday.

Source: FOREX.com

28.02.2011

Currency Charts

Currency Charts