All is Quiet Ahead of the ECB

With the rate decision and statement of the European Central Bank due a bit later in the day, Asia was a victim of very tight ranges in an unspeakably quiet session. The ECB will announce its interest rate decision later at 12:45GMT and while no one expects a hike from current levels at 1.00%, the following statement may supply the spark for the proverbial powder keg. Over the past month or so ECB members have been getting increasingly hawkish in tone laying the framework for future rate hikes aimed at battling inflation. Unless you have a short memory, you will recall last month’s meeting comments were very anticlimactic with a dovish tone after the weeks leading up to the meeting were laced with powerful rhetoric trumpeting how inflation was the enemy and will be fought vigilantly.

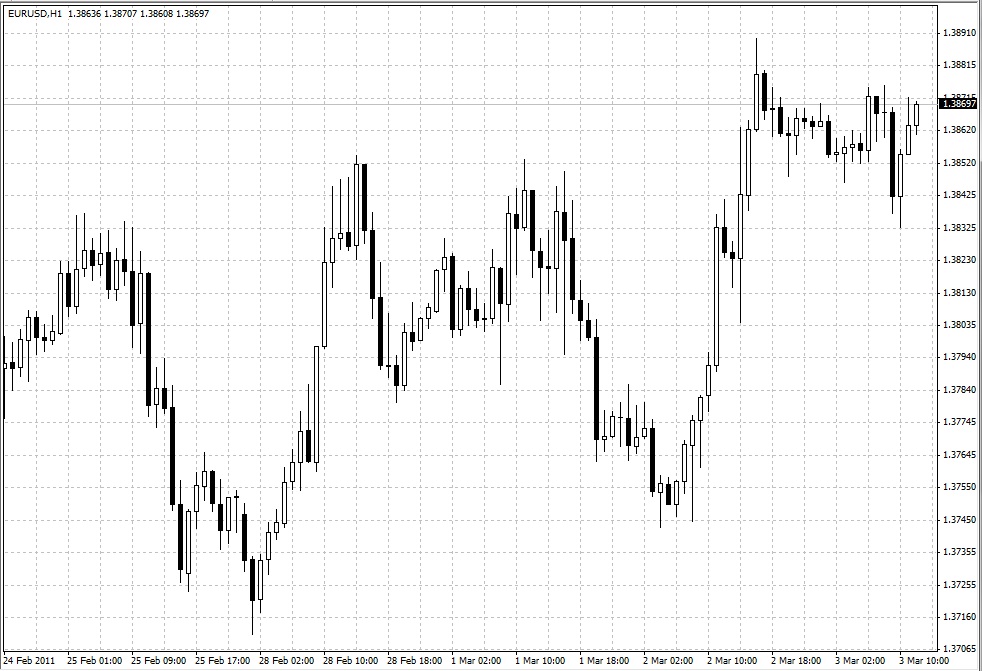

Looking at the markets today, there is not much to say as the EUR/USD was contained within a 25 pip range just off of earlier highs near 1.3890. The same story was seen across the board with the GBP/USD in a 14 pip range and the USD/JPY strangled in a 12 pip range. Even the AUD/USD was silent on a day that featured some top tier data in Australian building approvals and trade balance. While building approvals were awful, -15.9% versus -3.1% expected, trade balance came in strong at +1.88B versus a forecast of 1.53B. Despite this, the AUD/USD was choppy at best, stuck in a range of no less more than 25 pips. All in all a very quite session…

Looking ahead, the peacefulness should end in London with a slew of top tier data that will be capped off by the ECB statement at 12:45GMT. Prior to the big show we have retail sales out of the EU, Switzerland, and Germany, as well as UK PMI and GDP out of the Euro Zone.

Source: FOREX.com

03.03.2011

Currency Charts

Currency Charts