'Strong Vigilance’ for EUR/USD

Despite a spate of positive U.S. data surprises this week, the buck has failed to gain any traction against its counterparts. Trichet’s hawkish post-ECB rate decision commentary added fuel to the ‘USD weakness’ fire as the market interpreted his ‘strong vigilance’ reference as a signal of a hike to the ECB’s main refi rate as early as April. Taking a look back at the ECB’s past references to ‘vigilance’, however, suggests the market may be getting ahead of itself:

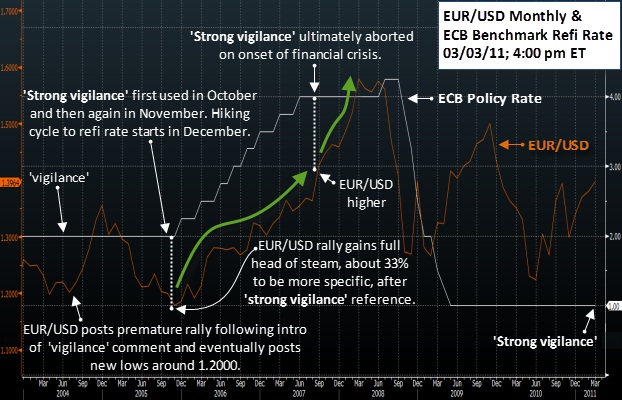

* Mid 2004 – ‘Vigilance’ used, slightly less hawkish and no rate hike until 2005 yet EUR/USD manages to rally about 12 big figures in less than 6 months.

* October 2005 – ‘Strong vigilance’ used but no hike in November. Regardless, EUR/USD upside followed.

* November 2005 – ‘Strong vigilance’ reiterated, EUR/USD upside continues.

* December 2005 – ECB begins tightening cycle after ‘strong vigilance’ referenced in prior two consecutive months.

* August 2007 – ‘Strong vigilance’ used again but no pursuant ECB policy action due to the onset of the financial crisis. EUR/USD still manages to gain another 20 big figures.

* March 2008 – EUR/USD up more than +33% since ‘strong vigilance’ comment first used in October 2005. Sharp EUR/USD declines follow.

The main takeaway from the preceding ‘strong vigilance’ analysis has nothing to do with the timing of the ECB’s next move but instead has everything to do with subsequent EUR/USD price reactions. While many view Trichet’s ‘strong vigilance’ comment as cementing an April rate hike, history shows otherwise – ‘strong vigilance’ was used twice in October & November ‘05 before the ECB eventually hiked in December. Ultimately, it doesn’t really matter whether the ECB begins tightening sooner or later for FX traders. Price action is what matters.

As noted in the chart above, past ECB ‘strong vigilance’ messages saw EUR/USD upside follow suit. Furthermore, EUR/USD strength was undeterred even when ‘strong vigilance’ comments were not accompanied by immediate rate hikes (August ’07). Average upside for EUR/USD moves post ‘vigilance’ messages calculates to around +1700 pips. This suggests EUR/USD trading above 1.5000 in the coming quarters.

However, the situational contexts then and now are quite different. Risks to extended EUR/USD strength may be more substantial in the current environment. The most obvious and possibly largest risk is the potential for Eurozone periphery issues to resurface. Such a development would pressure the ECB to reconsider tightening – whether further tightening is delayed or completely aborted would depend on the extent of deterioration in the periphery – which would likely put a cap on EUR/USD’s uptrend. An accelerating U.S. recovery poses another risk to extended EUR/USD strength. This past week’s myriad of positive data surprise – personal income, ISM manufacturing & non-manufacturing, Dallas Fed, ADP employment change, and weekly jobless claims – strengthens the case that the U.S. economic recovery may be picking up the pace. Tomorrow’s much anticipated NFP report will provide more insight on the matter – we think the risk is for a better than expected print considering both the ADP employment number and ISM non-manufacturing employment component printed higher this week. If this is the case, the greenback may receive a boost from increasing speculation of an early exit to QE2 on evidence of an accelerating U.S. recovery and/or substantial USD short covering.

Ultimately, such risks to continued EUR/USD upside are still ‘ifs’. However, EUR/USD price reactions to comments of ‘strong vigilance’ are not ‘ifs’ and suggests the path of least resistance is higher.

Source: FOREX.com

04.03.2011

Currency Charts

Currency Charts