Chinese Trade Deficit Hurts Risk in Asia

Risk in Asia began to soften early as the Reserve Bank of New Zealand set the tone of the day with a rate cut of 0.50% to 2.50%, surprising a market that was expecting a cut of only 0.25% for New Zealand. The NZD/USD took the news hard, collapsing over 50 pips to under 0.7335 in a matter of moments. New Zealand had announced last week that they would be cutting interest rates to help combat the damage done in the recent Christchurch earthquakes. The pair eventually recovered somewhat, but was looking to exit the session just off of lows close to 0.7350. Once the rebuilding in Christchurch is well underway and all of the infrastructure damage assessed, the RBNZ stated that rates will return to previous levels.

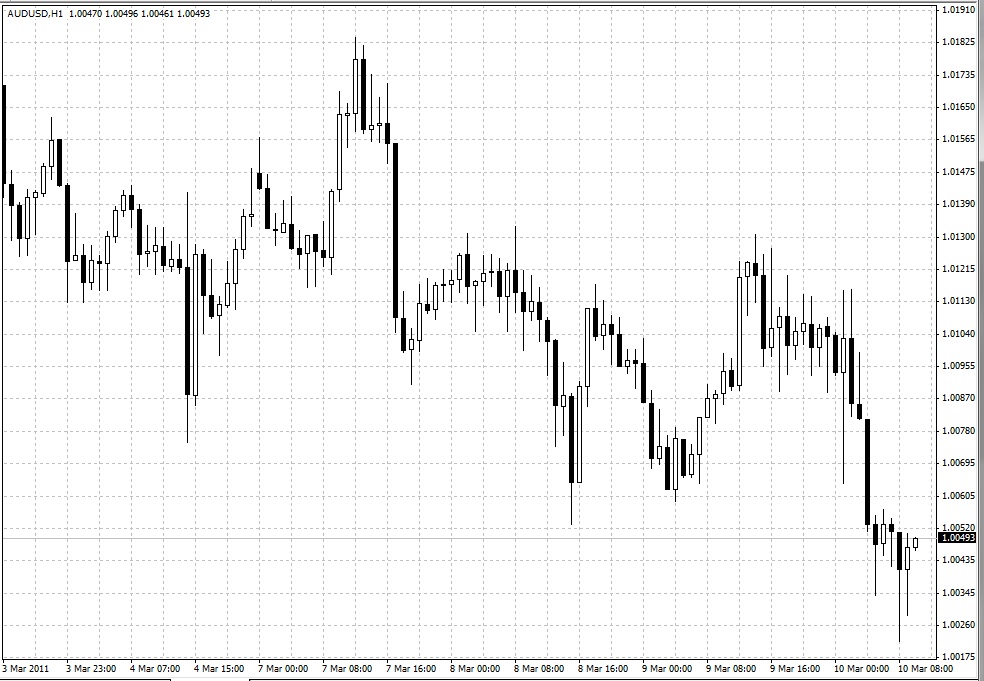

The risk aversion continued with disappointing employment data out of Australia. While the nation’s unemployment rate met expectations at 5.0%, 10,100 jobs were lost against a forecast that showed 20,800 jobs created. The AUD/USD saw a 40 pip move lower to 1.0070 on the data, but the pair recovered to 1.0105 after further investigation showed that most job losses were of the part-time variety. The 1.0105 level did not last long however as China released its trade balance data and shockingly showed a trade deficit of 7.3B as opposed to the market expectations of a profit of 4.9B. The data clearly set the risk off tone for the remainder of the day, eventually dropping the AUD/USD to lows at 1.0035.

The risk adverse atmosphere encapsulated the rest of the currency pairs, seeing EUR/USD drop from 1.3915 to 1.3865, and the GBP/USD slip to 1.6160 from 1.62100. As can be expected in this scenario, the yen crosses faded lower while dollar anchored pairs such as USD/CHF and USD/CAD rose higher. USD/JPY chirped a bit higher to 82.85, but in its 20 pip range it was barely worth mentioning. In commodities, XAU/USD remained centered near $1429.00 per ounce and oil pairs drifted higher ahead of tomorrow’s “Day of Rage” protests that were scheduled in Saudi Arabia.

Ahead in the London session look for the MPC rate statement out of the UK to be the main event with the bank expected to remain on course at 0.50%. Looking to tomorrow’s Asia session we have a slew of Chinese data including CPI, Industrial Production, PPI and Retail Sales.

Source: FOREX.com

10.03.2011

Currency Charts

Currency Charts