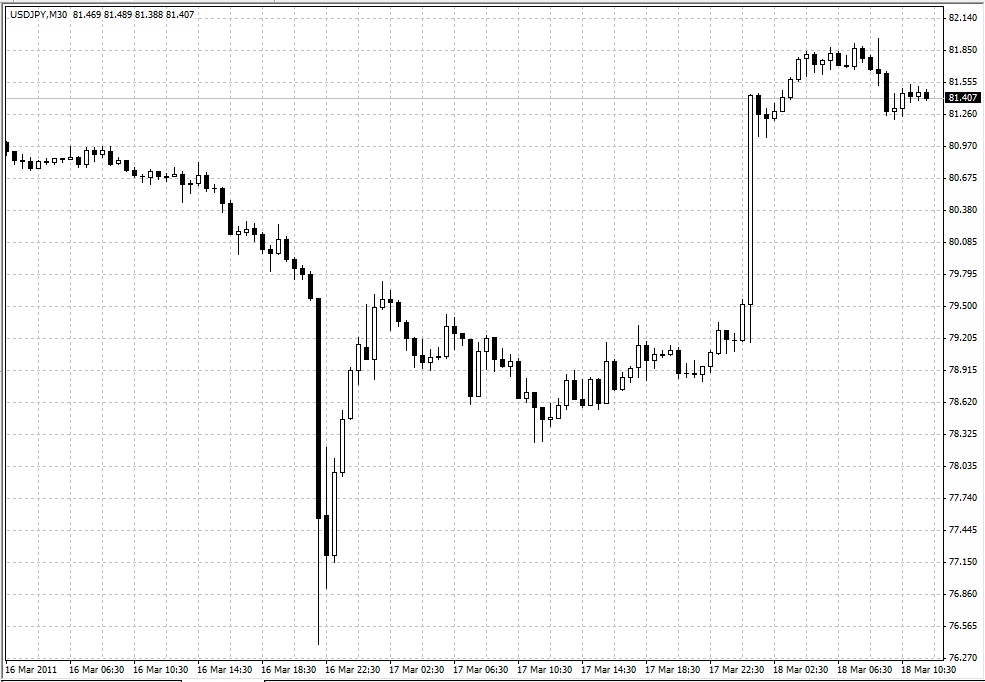

G7 Intervention Saves the Yen

The week in Asia finished up with as much action as when it began, with the G7 agreeing to mount joint intervention in defense of the rising Yen. At the behest of the Bank of Japan, members of the Group of Seven industrialized nations gave the nod for the first time in over a decade to help the limping nation of Japan fend off rising yen prices due to repatriation and speculation. The bold plan helped to smack the yen lower in a monstrous move, the kind of move that seems to have become commonplace over the course of this week here in Asian trade. The USD/JPY ignited from 79.15 to over 80.60 in a swoop, with eventual highs cracking the 81.80 mark later in the day. Across the yen crosses, EUR/JPY saw 115.20 on a 450 pip hike, GBP/JPY jumped to 132.50 from 128.00, and the AUD/USD rang up a 355 pip gain to highs at 81.35. Although generally expected, the intervention was a ferocious move that came like a left hook from the blind side. It does remain to be seen if the ECB will buy Euros against the yen on the London open or the FOMC will buy dollars against the Japanese currency as was alluded to by Finance Minister Noda in his statement. Regardless the BOJ seems to have a bit of firepower behind them this time around.

The intervention news helped put the UN vote to green light a “No-Fly” zone in Libya on the back burner, but initial reactions saw buying of crude oil and the safe haven Swiss Franc. WTI/USD popped over $1.25 to $104.00 per barrel, while BCO/USD saw similar gains to $116.25. USD/CHF dipped under 0.8975, but looked to end the session near 0.9050, 35 pips off the high after an accent higher. The story was the same for the other majors, with the AUD/USD showing the most dramatic results with a move from 0.9780 to 0.9945 over the course of the session. The markets saw cross yen buying lift the base currencies linked to the yen as traders anticipated central bank buying of home currencies against the beleaguered Japanese unit.

With the London session ahead, traders will mostly be interested in the resolve of the BOJ and its new G7 posse. What parameters have they put on the intervention and how solid is their resolve if the moves look to reverse? Perhaps this will help to stabilize the markets in Japan, but for how long? These are questions that should find answers sooner rather than later. This week in Asia has been one dynamic session after the other with little room to rest in between…Sadly the action is all due mostly to the ongoing tragedy that is still unfolding in Japan. As always, our thoughts go out to those who are now dealing with this catastrophe….Have a good weekend.

Source: FOREX.com

18.03.2011

Currency Charts

Currency Charts