A Quiet End to a Quiet Week

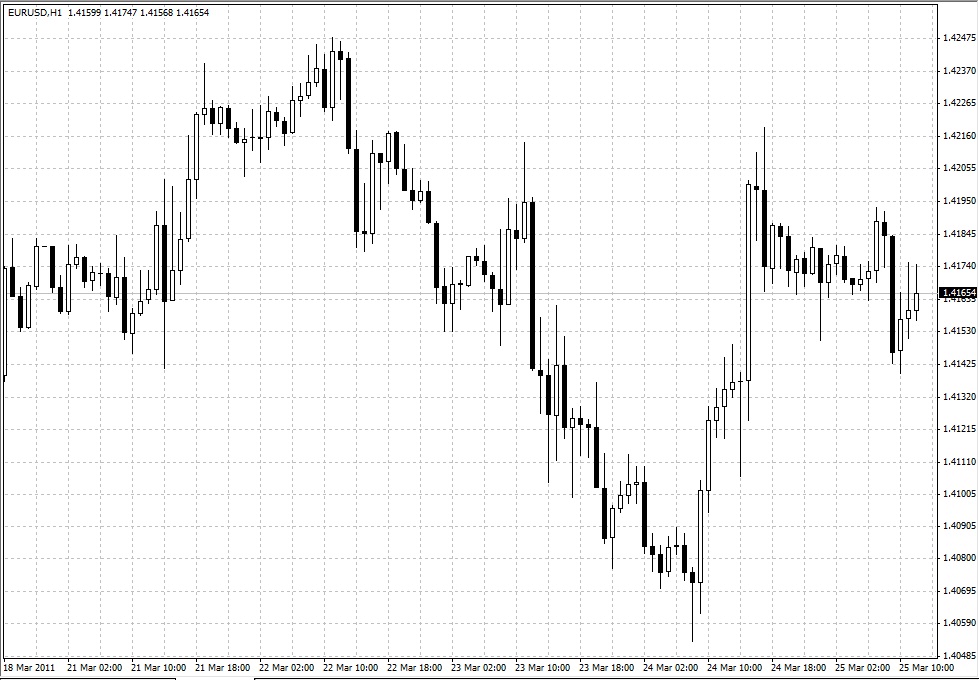

A peaceful end to what was a rather peaceful week in Asia despite the backdrop of unrest that still dominates Japan and the Arab world. The week ended with range trading on a quiet news and data day, offering few moves worthy of note. One of those few notable moves was in the EUR/USD, which saw its sideways progress interrupted when the S&P lowered Portugal’s credit rating to BBB. The pair dipped from 1.4177 to a session low just under 1.4150, but the pair quickly regained its footing and recovered back in step near 1.4170. Many traders now believe that it is just a matter of time until the nation turns to the EU and IMF for financial help. It seems that the markets have already priced in the bailout of Portugal, and are now looking ahead to see if Spain will be the next Nation to succumb to the sovereign debt crisis that has wreaked havoc in Europe.

Elsewhere in the currency realm it seemed that the weekend had already arrived. USD/JPY saw an 8 pip range for the day, while the yen crosses were content to casually drift sideways with no real news out of Japan pertaining to the nuclear disaster there. The drive the point home of how slow the day was, even the usually mobile AUD/USD was contained in a 25 pip range centered near 1.0200. Gold remained steady at $1433.00 while the crude oil pairs were equally steady at $105.50 for WTI/USD and $$115.80 for BCO/USD.

Ahead in London, look for the culmination of the two day EU summit that explored ways to firm up the current sovereign debt crisis and bailout issues. Next week will bring the ever volatile US NFP employment data. Have a great weekend…

Source: Forex.com

25.03.2011

Currency Charts

Currency Charts