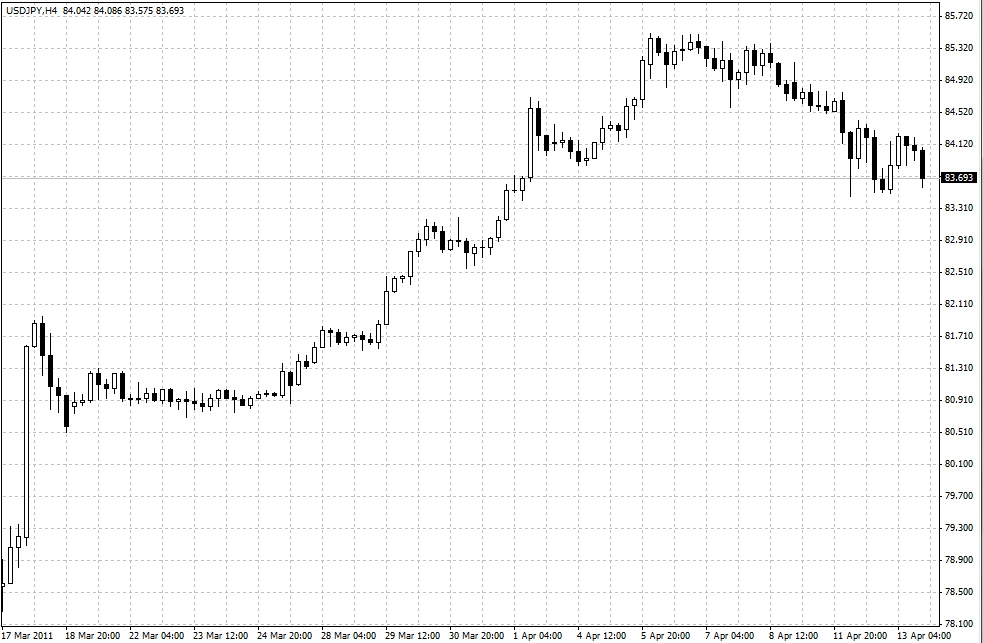

A Choppy Day for the Yen

The yen was pulled off of 83.50 session highs against the US Dollar as markets seemed to stabilize after yesterday’s huge wave of profit taking of yen shorts. Right out of the gate in the opening hours of Asia, USD/JPY touched support at 83.50 and blasted to 84.15 highs with the crosses in tow. After a quick pullback, the USD/JPY pair as well as the crosses are looking to retake session highs as the day winds down. EUR/JPY shot from 120.80 to 121.95 but retraced back under 121.30 before climbing back to the earlier highs. This pattern was also copied by the other yen crosses, which enjoyed a less risk adverse atmosphere today in Asia despite another major aftershock in Japan. Yesterday saw many investors close out short yen positions as commodities slipped and risk faltered as conditions worsened at the Fukashima Nuclear plant in Japan. Many investors use the low yielding Japanese unit as a funding currency for higher yielding and riskier products such as commodities and equities.

In the majors, the sailing was less dynamic with the Euro seeing just a hiccup amidst the EUR/JPY buying. EUR/USD remained smooth, trading between 1.4455 and 1.4490 on the day. With employment data on deck for later in the day, the GBP/USD remained on a straight sideways course that was only interrupted by the same pop in the GBP/JPY. The AUD/USD saw a choppier session with an initial 60 pip blast to 1.0490 that was stalled by rumors of heavy bids at the 1.5000 big figure. The pair than dropped to fresh lows under 1.0430, only to end the day at current levels closer to 1.0470.

In commodities, XAU/USD looked to recoup New York losses as the pair crept from $1450.00 to just under $1458.00 while XAG/USD grew from $39.95 to $40.35 on the session. Looking at oil, BCO/USD gained over a buck to $121.70 and WTI/USD remained steady at $108.80 per barrel as we saw no fresh news out of Libya.

As mentioned earlier, the big event ahead in the London session is sure to be Claimant Count Change out of the UK with a forecast of -3.6%, up from last month’s -10.2K.

Source: Forex.com

13.04.2011

Currency Charts

Currency Charts