The dollar extends its decline

There was a brief respite for the dollar overnight after the Beige Book showed that economic activity generally continued to improve last month, yet there was no sign of wage pressures (or second-round inflation effects), which makes a rate hike less likely from the Fed in the near-to-medium term. Added to this, retail sales excluding gasoline and autos surprised to the upside, increasing by 0.6 per cent last month and data for February was also revised higher to 0.9 per cent. So, underlying consumption growth in the US economy appears to be growing at a fairly healthy clip.

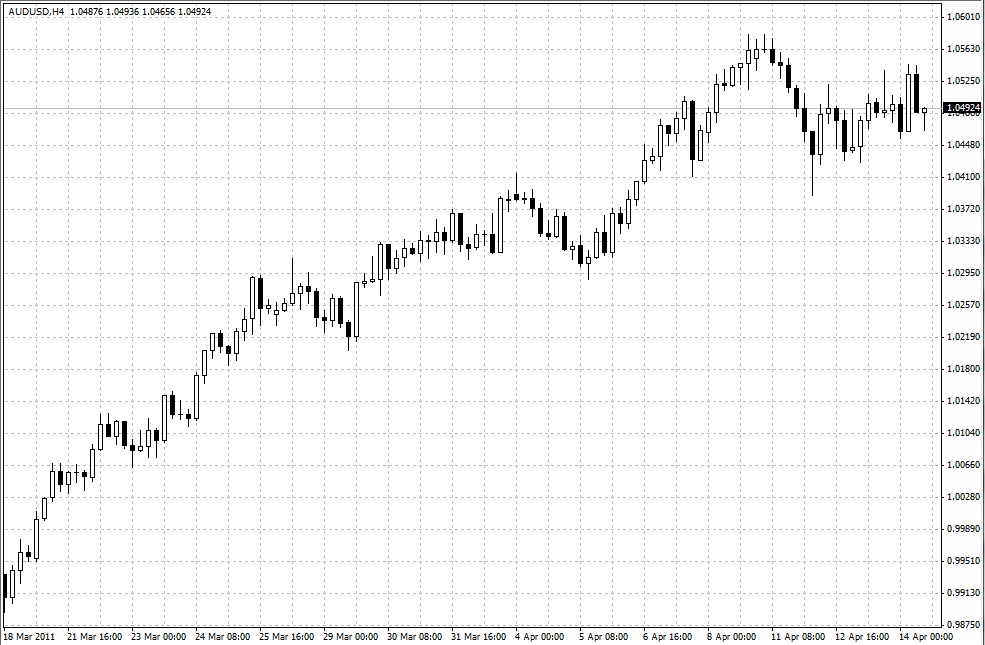

However, two things continued to dampen sentiment for the dollar. The first thing was a report by China’s State Council that the nation would implement “prudent” monetary policy going forward to eliminate the “monetary factors fuelling inflation.” This comes a day before the Chinese authorities release Q1 GDP data along with its inflation rate for March. The market expects inflation to rise to 5.2 per cent and growth to moderate to 9.4 per cent form 9.8 per cent in Q4 2010. The State Council seemed to suggest that Beijing won’t tighten monetary policy to such an extent it would threaten growth, but merely to dampen inflationary pressure. This was warmly received by the risky currencies on the forex spectrum including AUDUSD, which remains above 1.0450

The second is the deficit-reduction plan announced by President Obama yesterday. The plan to trim $4 trillion from deficits over the next 12 years is definitely a step in the right direction, but Obama was fairly slim on detail. Although he pledged to scrap tax cuts for high earners, this came up against criticism from the Republicans. The fight to reign in the US’s huge deficit will be fought along party lines and this increases the chances that it will be plagued by political deadlock. This calls into question the credibility of the US’s fiscal consolidation plans. Right now these fears are being played out in the forex markets and the dollar is losing its grip on important support - 75.00 in the dollar index. Below here we could see another leg lower in the dollar. However, fears about the US’s fiscal future do not seem to be affecting credit markets and Treasury yields continue to fall.

The markets’ rally in risk has come off the boil this week and stocks are set for their worst weekly performance since the start of the year. There is still a lot of uncertainty out there: high oil prices, Japanese nuclear disaster and a normalisation in monetary policy from Singapore to the Eurozone. Added to this the market will also start to digest what $4 trillion of deficit reduction means for the US economy. This could cause a period of consolidation in stock markets and we may trade sideways until things become a little clearer. Right now 1,340 in the US 500 index is stiff resistance, while 1,280 is strong support.

Earnings season has been mixed. Although JP Morgan had an enormous 70 per cent jump in quarterly profits the detail of the results that were announced yesterday were fairly weak. Retail bank profits fell and foreclosure costs also increased, so it is not all rosy on Wall Street. Later today Google announces earnings; the market is looking for $8.12 per share. Tomorrow all eyes will be on Bank of America who announces its results at midday BST (0700 ET), analysts expect earnings to be $0.263 per share.

The ECB monthly report showed that the ECB remains concerned about inflation pressures and will do all it can to stub out second-round effects of price pressures. This suggests that there could be further rate hikes from the ECB, and makes tomorrow’s final inflation print for March extremely important. If it is revised up from the current 2.6 per cent then we could see more tightening start to get priced in, putting upward pressure on the euro. ECB speakers have also been on the hawkish side. This morning Bini-Smaghi said that ECB policy should not be set with only small countries in mind, which suggests that the ECB could embark on a tightening cycle while peripheral members embark on stringent fiscal consolidation programmes. Tomorrow is a key for the euro, and we expect to hover between the 1.4400-1.4500 recent range.

Elsewhere, the Monetary Authority of Singapore re-valued the Singapore dollar today to combat inflation pressures. Commodities are rising in line with a weaker dollar and silver and gold continue to benefit from their position as inflation hedges. USDJPY is very weak and is back to the 83.10 level. However, due to the intervention risk for the yen, further losses below 83.00 in USDJPY could be limited.

Ahead today US initial jobless claims will be watched for a further improvement in the labour market in the US. Producer prices will also be in focus. However, we expect markets may be fairly quiet today before Chinese data tomorrow followed by inflation reports from the Eurozone and the US.

Source: Forex.com

14.04.2011

Currency Charts

Currency Charts