Dollar Freefall Continues

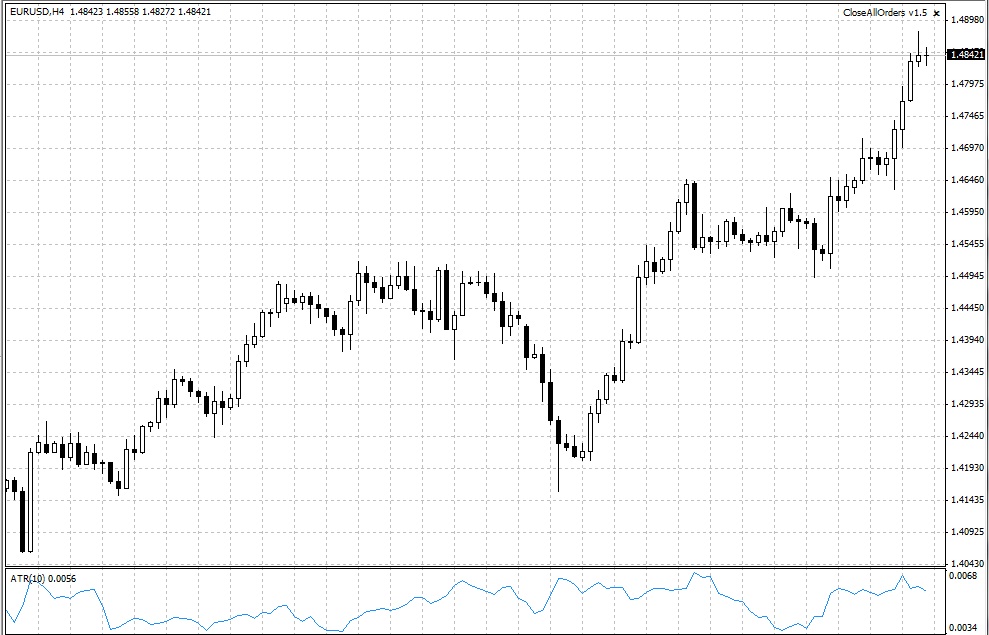

The US Dollar remained the victim once again in Asia after FOMC Chairman Bernanke failed to help boost morale for the greenback earlier in the day. With the US Federal Reserve Bank showing no signs of boosting interest rates anytime soon, the green light was given for investors to continue selling the listless greenback. With dollar bears out in full force the majors were simply on fire today. The AUD/USD blasted over 70 pips to fresh 29 year highs just over 1.0940. The persistence of this pair has been unbelievable and it’s almost hard to believe that it was resting near 0.6000 during the height of the financial crisis in 2008. While the Aussie was forging ahead, so did the EUR/USD and the GBP/USD. The EUR/USD saw 1.4880 highs after lows closer to 1.4630 prior to the FOMC statement. The GBP/USD pushed higher by a big figure to 1.6745 to post fresh 17 month highs in the pair. Simply put, almost anything paired against the dollar rose higher today.

Looking past the dollar, the first moves of the day belonged to the NZD/USD which was pummeled when the RBNZ left rates unchanged and made it clear that rates would be on hold for quite a while. The pair did a straight line decline from 0.8075 to lows at 0.8005, but thriving in the weak dollar climate, the pair made it back to 0.8080 by the session’s close. The World Bank raising China’s GDP forecast from 9% to 9.3% helped boost sentiment down under as well.

USD/JPY remained heavy on the weak dollar, dropping from 82.20 to near 81.60 on the day. The yen crosses were pulled higher by the strength of the majors, but didn’t have the dynamic moves that were seen in the majors. Looking at the crosses, GBP/JPY saw 137.00, EUR/JPY saw 121.80 and the AUD/JPY over the 89.50 mark. Markets had no reaction to the Bank of Japan leaving rates unchanged at <0.10% as was generally expected.

Looking at the precious metals, XAG/USD remained within a 90 cent range with a $48.70 high and XAU/USD stuck within a $10 range with the top end representing a fresh all time high near $1533.25.

While the London session ahead looks quiet data wise, later in New York we’ll see Advance GDP, Unemployment Claims and Pending Home sales data. Keep in mind that tomorrow Japan will be out for the Showa Bank Holiday and the UK will be shut down in honor of the Royal Wedding.

Source: Forex.com

28.04.2011

Currency Charts

Currency Charts