Weekly Oil Market Outlook - A firming USD weighing on oil prices

On Thursday, crude oil prices retreated below $100/bbl and $110/bbl in WTI and Brent, respectively. The pullback in crude oil and commodities in general stemmed largely from a rebound in the dollar. Post ECB rate decision comments from Trichet lacked the term ‘vigilance’ which market participants interpreted as a signal that the next rate hike would be pushed back to July. Sharp EURUSD downside promptly followed suit as the single currency ended the day almost three big figures lower around 1.4530/35.

History can at times provide a blueprint for the future. The economic conditions of the 1970’s draws many similarities to recent times in terms of booming commodities (the CRB Index rose +250% during the decade), a falling dollar, and rising inflation. Commodities, however, peaked in the 1980’s as the USD almost simultaneously carved out a bottom.

While it’s certainly too early to speculate for a repeat of the 1980 commodity reversal to occur in 2011, Thursday’s massive selloff in commodities warrants that at the very least such a scenario should not be entirely dismissed. If a similar scenario were to play out, the downside implications for crude oil would be significant. Following the peak in 1980, commodity prices declined for 20 years as the inflationary period of the 70’s was replaced by a period of disinflation. While such a dramatic shift in conditions is not likely to take place, it does serve as a good example of the dollar’s influence on commodity prices.

Another possible explanation for the sharp selloff in commodities may simply stem from over-positioning. Positions were heavily skewed to the ‘short USD’ and ‘long commodity’ end of the spectrum as expectations for ECB hikes were ramped up on the back of hawkish ECB rhetoric and seemingly unstoppable upside in commodities. As one-sided positioning escalates, so too does the risk for a squeeze in the opposite direction.

At the moment, it’s difficult to identify whether the recent commodity selloff is the beginning of a larger reversal or merely a massive position squeeze. Simultaneous USD strength, however, suggests the fate of the dollar may determine the near term fate of commodities and subsequently crude oil prices. The risk seems skewed for the USD rebound to extend a bit further considering upcoming US data and events in the days to weeks ahead. The much anticipated US NFP report is set for release tomorrow - a much better than expected print (Bloomberg economists consensus is +185k) may provide an added boost to the current USD rally. Additionally, expectations for Fed policy normalization would also be ramped up as the end of QE2 draws closer. The result – USD support alongside continued pressure on crude oil prices.

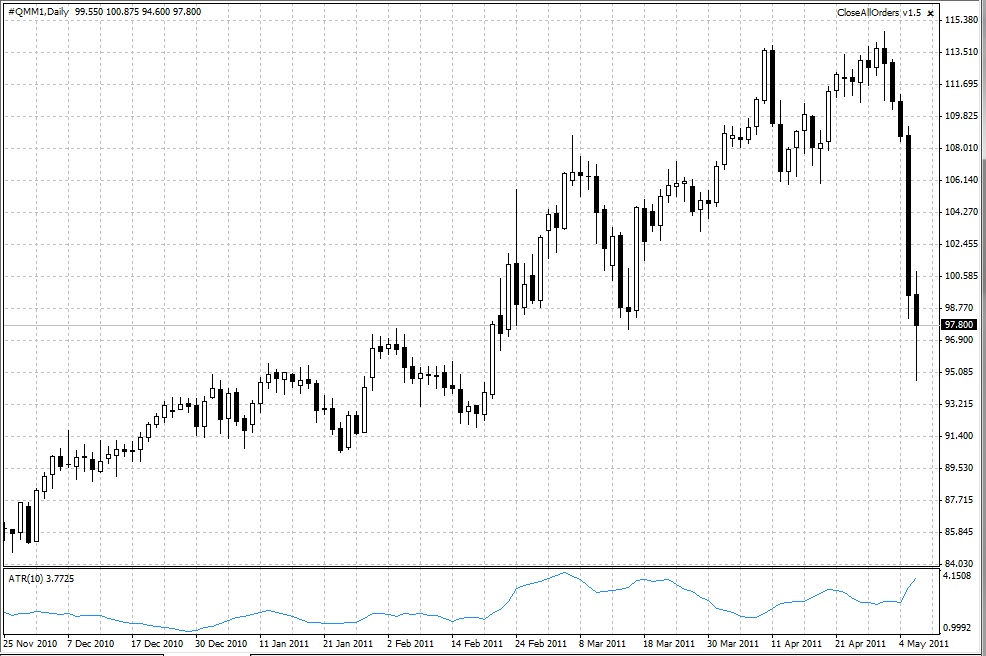

Overall, we think crude oil prices may continue to slide lower in the week ahead. However, the 100-day SMA may stall the decline as the key moving average has provided decent support for WTI since Q4 ’10 – WTI crude oil prices have only managed to dip below the 100-day SMA by approximately $2 before resuming its uptrend since. Accordingly, we think the longer term crude oil uptrend remains intact and expect prices to trade within a $95/105 and $105/115 in WTI and Brent, respectively, in the week ahead

Source: Forex.com

06.05.2011

Currency Charts

Currency Charts