Swiss Steals Spotlight

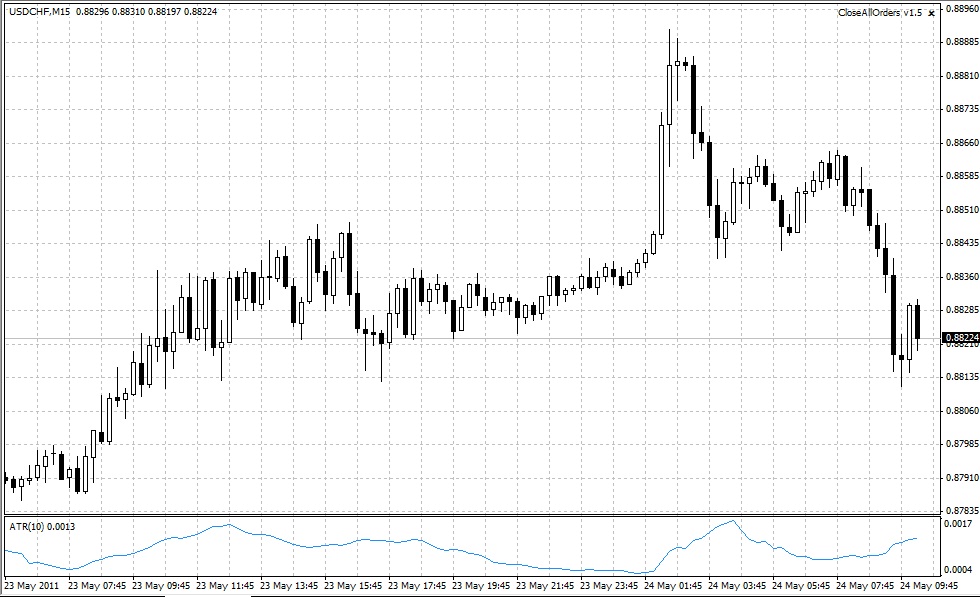

The troubles in the Euro Zone remained the focal point of currency markets yet again, but the spotlight was shared by the Swiss Franc and British Pound which saw comments spark major moves. Early comments from the SNB’s Thomas Jordan that the central bank is concerned with the appreciation of their currency and will act if needed sent the Franc screaming lower. USD/CHF shot from .8845 to .8890 on the comments while the EUR/CHF added 60 pips to 1.2460. Rumors of the SNB on the bid at 1.2360 helped keep the pair well bid fro the entire session. The moves also helped to turn around a sagging EUR/USD which eventually dug out of a 1.4005 hole to see 1.4065 highs despite continued fears of contagion in the Euro Zone. Many have been questioning the EU’s stability with the recent downgrade of Italy and the overwhelming defeat of incumbents in yesterday’s Spanish elections which may threaten recent austerity measures.

A deep slide in the GBP/USD was instigated by a blog that said Moody’s will mention later today that it has issue with several UK banks due to their creditworthiness. GBP/USD slipped from 1.6120 to near 1.6060 as the news spread. The pair eventually rebounded and was last seen near 1.6120 heading into the London session. Another lager market mover today was the NZD/USD, which saw inflation expectations rise from 2.6% to 3.0%, propelling the currency from 0.7910 to 0.7965 rather quickly due to the enhanced expectation of a rate hike to curb the said inflation.

Looking at the yen crosses, poor risk appetite kept the crosses soft for the better part of the day with a late session turnaround bringing them back near unchanged. GBP/JPY did not fare as well due to the downgrade chatter, and remained almost 50 pips under session highs of 132.20 heading into London. USD/JPY gently slid from 82.05 highs to current levels near 81.80.

Ahead, the London session is rife with data, most notably German Ifo at 8:00 GMT. Added to this, London will see German GDP, UK public sector borrowing and EU industrial new orders.

Source: Forex.com

24.05.2011

Currency Charts

Currency Charts