Markets wait for Trichet

The market will be all ears for the phrase “strong vigilance” during the ECB President’s press conference later this afternoon. The market expects the ECB to remain on hold, but for Trichet to signal a rate hike next month. Quarterly rate rises for the rest of this year are now expected by the market, so any deviation from this pattern could send the euro plummeting.

There is no doubt that the euro has benefitted from the interest rate differential especially relative to the dollar. This has helped to support the single currency even when sovereign debt concerns have dented risk appetite. Although the euro came under some pressure at the end of yesterday on the back of reports that the new EU/IMF/ ECB financial rescue package from Greece will include a contribution of about EUR30bn from private bondholders.

This is most likely on Germany’s request after Finance Minister Schauble said that bond holders must share some of the burden of bailing out Greece. And it looks like burden sharing could happen sooner than 2013 when the ESM comes into play, after Schauble said that if Greece does not get more funding then it will be insolvent by Mid-July.

The next few weeks could thus see some serious wrangling between Germany and the ECB. The central bank wants bond rollovers – essentially a non-default event. However, Germany wants something more severe – bondholders to accept a 7 year extension to the maturity of their bonds, which is a totally different contract to what investors’ first signed up to and would likely constitute some sort of default.

The details of the EU/ECB and IMF report on Greece were finally released yesterday and the reading was grim. The current bailout was deemed insufficient and it confirmed that Greece would not be able to return to the financial markets next year. The report added that although cross-party support within Athens would not necessarily halt the flow of further funds, it would be difficult to implement a further aid package without political support for more austerity measures.

So while the Greek crisis reaches a critical phase the euro’s fortunes essentially rest with Trichet this afternoon, so watch out for his speech at 1330BST/ 08030 ET.

The BOE also announces interest rates today. It is set to keep rates on hold and there are no reasons to believe that new member Ben Broadbent will change the balance of voting, although the minutes later this month will be interesting to see if he followed his predecessor Andrew Sentence and voted for a hike.

The pound had a storming session this morning but has since fallen off a little. Rumours of some short-term demand for pounds versus the dollar and the euro suggest that there may be a reversal later today, especially if the BOE does do what the market expects and keeps on hold. Since the BOE doesn’t release a statement with its policy decisions when it remains on hold, the pound is unlikely to be the major story in FX today.

Elsewhere, the Kiwi dollar shot to record highs versus the greenback after the RBNZ sounded a more hawkish note at its policy meeting overnight. The statement noted that as GDP picks up later this year this will cause inflationary pressure that will require tighter interest rates over the next two years. This was a green light to go long Kiwi and the pair reached 0.8250. The next step is 0.8300. AUDNZD also nosedived as and is back to January lows. While the RBA seems to be nearing the top of its cycle, the RBNZ is only just getting going due to rising inflationary pressures. This may well cause further weakness in Aussie versus the Kiwi.

The Aussie is coming under pressure after labour market data disappointed; the number of jobs created last month was only 7.8k, versus expectations of 25k. This suggests that like the rest of the developed world Australia is going through a summer (or winter) malaise.

In the US the Fed’s Beige Book survey of businesses confirmed a moderation in activity but no signs that a double dip is imminent. The businesses referenced did notice that disruptions caused by the Japanese earthquake had impacted business, which suggests there could be a bounce back in activity later this year. This makes a further round of monetary stimulus unlikely at this stage, in our view.

Yesterday’s shocking OPEC meeting, which saw no change to oil output caused oil prices to spike, but more worryingly it highlights the cartel’s ambivalence to the economic moderation in the West. Brent crude has come off slightly today, but $100 per barrel oil is here to stay and is likely to be a floor not a ceiling. Also, with Saudi Arabia likely to pump more oil, this may increase the risk premium per barrel as it would reduce the supply cushion in the market. So, expect a summer of high oil prices…

There are also some reports that President Obama may be preparing for a further round of fiscal stimulus to help boost the US economy’s flagging fortunes. Reports suggest the government is preparing a temporary payrolls tax cut to boost hiring. This would be a further tax cut after the December 2010 Bush tax cuts extension. However, this weighs on the US’s fiscal position and makes it even more crucial that the US Congress raises the debt ceiling before it expires later this year. Further fiscal pressure is not dollar positive over the medium-term in our view.

Looking ahead, Trichet is likely to dominate the tone of the markets.

Source: Forex.com

09.06.2011

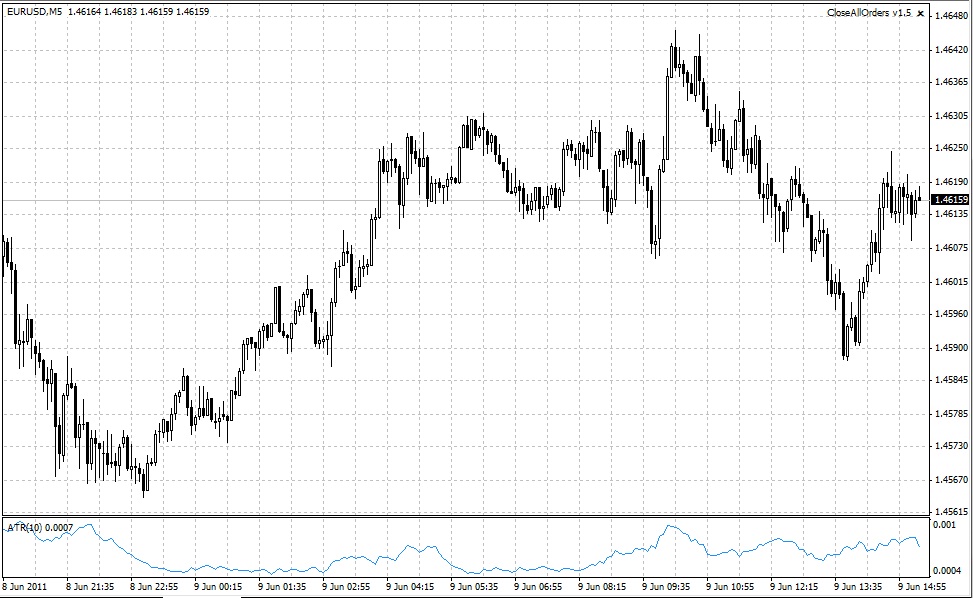

Currency Charts

Currency Charts