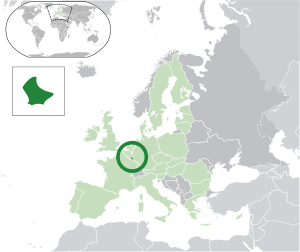

Luxembourg

Located in Western Europe between France, Germany and the Netherlands. Included in the Benelux countries (Belgium, Netherlands, Luxembourg). He is a member of the European Union.

Capital

Luxembourg

Official languages

Luxembourgish, French and German

Monetary unit

Euro

Government

Constitutional monarchy

Economy

The economy is focused on the development of services, including in the financial field. Many new companies were created by large U.S. firms. A very attractive factor for foreign companiesis is that local workers know several languages.

Corporate legislation

- Law of 6th December 1990 (Tax Reform)

- Grand-Ducal Decree of 24th December 1990 (Soparfi)

- Grand-Ducal Regulation of 28th December 1990 (Listing Requirements)

- Law of 19th July 1991 (Dedicated Funds)

- Law of 22nd December 1993 (Double Taxation)

- Law of 31st July 2006 (Labour Code)

- Law of 13th February 2007 (Specialized Investment Funds)

- Law of 11th May 2007 (Societe de gestion du Patrimoine Familiale (SPF)

- Loi du 15 juin 2004 relative a la Societe d'investissement en capital a risque (SICAR)

- The EU Parent-Subsidiary Directive 90/435/CEE.

Types of companies

- Open limited liability company (SA)

- Closed limited liability company (SARL)

- Limited Partnership (SCS and SCA)

- Partnerships with unlimited liability (SENC)

- Holding (SOPARFI)

- Venture Capital Company (SICAR)

- Fund (Securitization Company)

- Specialised Investment Funds (SIF)

Open limited liability company (SA)

- Company name must end with "AG" or "SA".

- Share capital - 31 000 Euro, 25% must be paid at the time of registration.

- SA has the right to issue registered shares and bearer shares. It is not necessary for the transfer of shares to have the approval of the general meeting of shareholders.

- The SA shareholders can be both legal persons and individuals who are residents of any country in the world. The minimum number of shareholders is two, the maximum is not limited. A shareholder has the right to act as the nominal holder of shares of another shareholder. Liability of shareholders is limited to the sum of the subscribed (and not necessarily paid) share capital.

- The minimum number of directors of SA is three natural or legal persons (they make up the Board of Directors). The presence of nominee directors in the company is not forbidden. The company must have a corporate secretary, who files the annual report to the Registrar.

- SA, which is a common resident company, pays taxes on profits from commercial activities ranging from 16% to 30% (subject to municipal taxes - up to 40%). Agreements on avoidance of double taxation, signed by Luxembourg are applied.

- Financial statements must be submitted annually to the Register of Companies. It should be verified by an auditor if: annual balance sheet of the company exceeds EUR 3.125m, or sales exceed EUR 6.25m, or the company has more than 50 employees.

Closed limited liability company (SARL)

- Company name must end with "Gmbh", or "SARL".

- Share capital is 12 500 Euro, 100% of it must be paid at the time of registration.

- SARL can issue registered shares and bearer shares. Transfer of shares may be effected only with the approval of the general meeting of shareholders.

- The shareholders of SARL can be both legal persons and individuals who are residents of any country in the world. The minimum number of shareholders is one, maximum is 40.

- Minimum number of directors (managers) is one entity or person.

- The presence of the Secretary is not required.

- If the company has less than 25 shareholders, the annual meeting is not mandatory.

- SARL, which is a common resident company, pays taxes on profits from commercial activities ranging from 16% to 30% (subject to municipal taxes - up to 40%). Agreements on avoidance of double taxation, signed by Luxembourg are applied.

- Financial statements does not require an audit.

Holding SOPARFI

- Not a separate legal entity.

- Must possess at least 10% (or a minimum of 1.25 million Euro) of the authorized capital of the subsidiary.

- Holding has the right to redeem up to 10% of its shares, if it is foreseen in the charter and consent of the general meeting of shareholders is obtained.

- Requirements for company shareholders and directors are identical to the requirements for SA or SARL.

- Holdings SOPARFI pay standard taxes. Income tax is not levied only on dividends received from the sale of shares in subsidiaries. SOPARFI can apply Agreements on avoidance of double taxation signed by Luxembourg.

- Holding SOPARFI has no limitation on kinds of activities (may be engaged in commercial, financial management activity, etc).

Limited Partnership

- Does not require payment of the share capital.

- In partnership with limited liability and with the issue of shares the capital is distributed among the partners in the form of shares (registered and bearershares ). The partnership is established by a natural or legal persons, residents of any country in the world. At least two of them should be the general partners.

- The management in all partnerships is implemented by general partners.

Requirements for financial accounting

E-filing of annual report is allowed. Since 2011, companies must use a standard chart of accounts. Since 2013, electronic filing of quarterly and monthly reports on VAT will be mandatory.

Agreements on avoidance of double taxation

Luxembourg has signed agreements on avoiding double taxation with 64 countries in the world, including such countries as Germany, Austria, Armenia, Barbados, Denmark, Spain, Finland, France, Georgia, Hong Kong, Iceland, Japan, Liechtenstein, Mexico, Monaco, Moldova , Norway, Panama, Netherlands, Portugal, Qatar, the United Kingdom, San Marino, Sweden, Switzerland and Turkey.

Currency Charts

Currency Charts